A Balance Sheet report gives you a financial snapshot of your company as of a specific date.

The Balance Sheet calculates how much your business is worth (your business's equity) by subtracting all the money your company owes (liabilities) from everything it owns (assets). Your company's total equity includes your net income for the fiscal year to date.

Balance Sheet Budgets, like Profit & Loss budgets, help you manage your financial performance and plan for future financial goals.

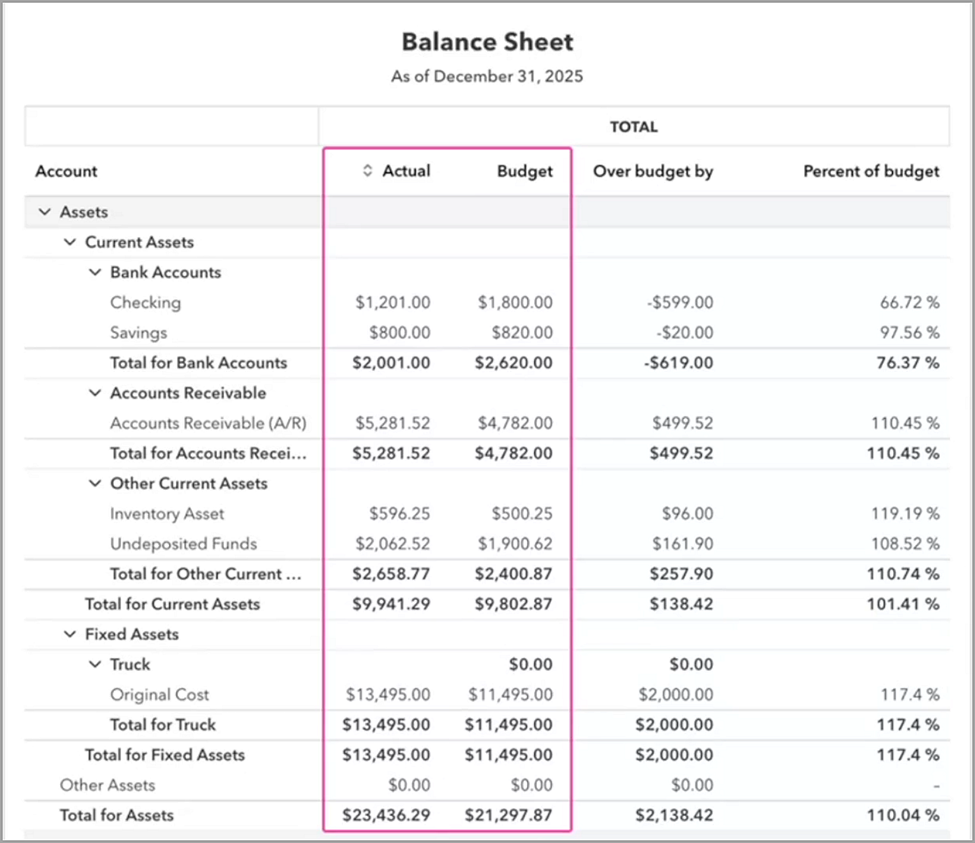

QuickBooks Online (QBO) lets you create balance sheet budgets to track your assets, liabilities, and equity against your planned business activities. QBO also provides tools for viewing and comparing your balance sheet budgets with your actual data.

To create and report on Balance Sheet budgets in QBO:

- Navigate to Budgeting: Inside QBO, or QBO-Accountant, go to Settings ⚙ and select Budgeting.

- Create New Budget: Select Create New, then choose Balance Sheet as the budget type.

- Set the Fiscal Year: Specify the fiscal year for your budget.

- Choose a Period: Select if you want to budget on a yearly, quarterly, or monthly basis.

- Enter Budget Amounts: Input your budget amounts for each account for each period.

- Save Your Work: Make sure to Save your budget.

- Report Your Budget vs Actual: Run a "Budgets vs. Actuals" report to compare your actual balance sheet values against your budgeted balance sheet amounts.

By comparing your Balance Sheet actual with your Budgeted Balance Sheet values, you can identify areas where you may need to adjust your spending, accelerate your revenue (Accounts Receivable) collections, re-balance your inventory to more closely reflect your sales expectations, and also work at lowering your debts (liabilities) to a more manageable percentage of your overall profitability.

Footnotes and Disclosures:

Feature content was adapted from Intuit media source content including QuickBooks Online 'In-product Help'. Graphic content adapted from 'live' QuickBooks Online - Accountant screen capture based on a Hands-on Task within the 2025 QuickBooks Online Recertification Level 2 preparation guide.. Content created or otherwise adapted by Insightful Accountant is furnished for educational purposes only.

As used herein, QuickBooks®, QuickBooks Online (QBO) and QuickBooks Online Accountant refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Other trade names or references used herein may refer to registered, trademarked or copyrighted materials held by their respective owners and included for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.