Three-way Financial Planning & Analysis Now in Intuit Enterprise Suite

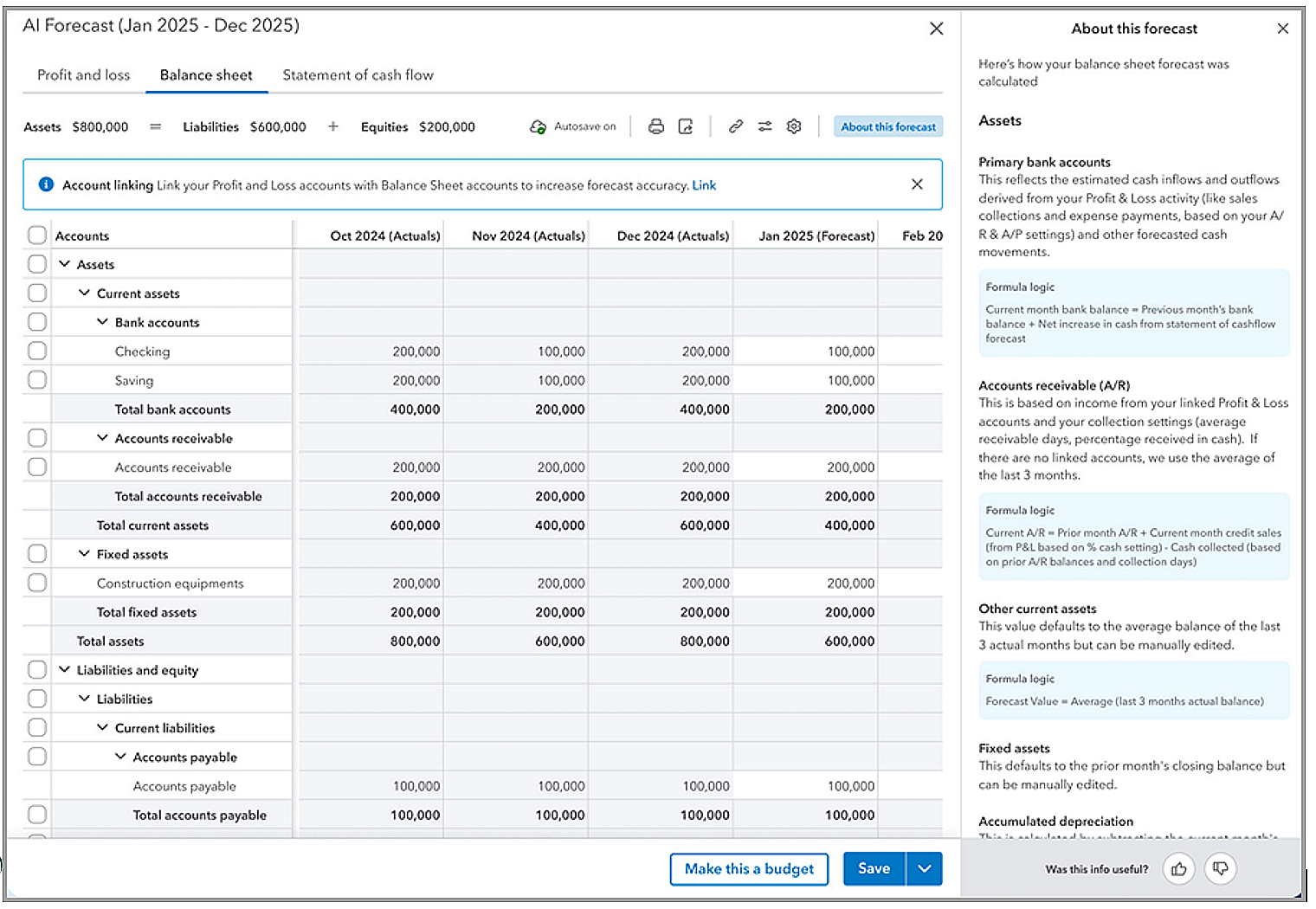

When you need Financial Planning and Analysis of your Intuit Enterprise Suite (IES) data, you can now create a three-way financial plan to communicate your business goals for key stakeholders by producing unified forecasts across all three financial statements.

IES allows you to generate a comprehensive financial forecast across your P&L, Balance Sheet, and Statement of Cash Flows by linking the appropriate P&L accounts with the corresponding Balance Sheet accounts.

The 3-way financial planning function enables you to adjust your forecast, and the impact of these changes will then propagate to the related accounts in all three financial statements. This allows you to edit your forecast to reflect changes in your strategy.

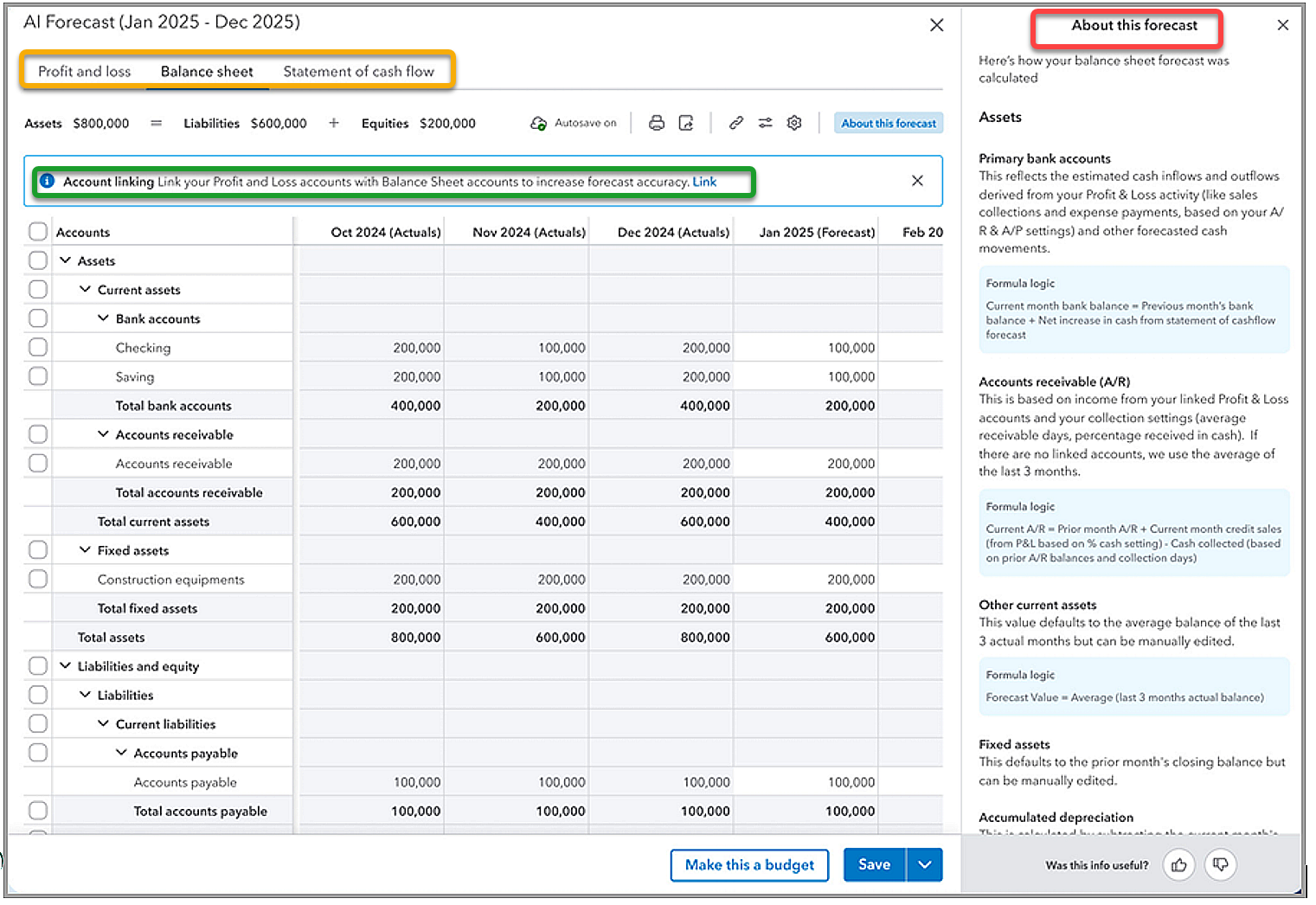

For step-by-step please refer to the sections below, reference the graphic at the bottom of this article for highlighted content within the step-by-step details.

First-time Forecasts

1) From Financial Planning, select View detailed forecast to get started.

2) If your company has sufficient data, an AI-generate forecast will be displayed that includes net income, income, and expenses.

3) Select Profit and loss, Balance sheet, or Statement of cash flow to view each AI-generated forecast. (Highlighted in the Yellow box below)

4) Choose About this forecast to learn more about the accounts and rules used to generate the forecast.

Custom Forecasts

You must be signed-in to Intuit Enterprise Suite as an Admin or Standard All user.

1) From Financial Planning, select Create custom forecast to get started.

2) Choose the time frame you wish to create the forecast for.

3) Select a Forecast method:

- Average of actuals

- Actuals from last fiscal year

- Budgets

4) If you selected Average of actuals, choose the past actuals duration to be used to calculate the average.

5) To set rules at the account type level, choose Set rules. The accounts used to create the forecast are based on your chart of accounts.

6) Select Next.

7) To link the Profit & Loss accounts with your Balance Sheet accounts, click the Link option on the Report. (Highlighted in the Green box below)

8) If desired, select 'the pencil' to Edit the name of your forecast.

9) Select Save and close.

Viewing Forecasts

1) From Financial Planning, select View detailed forecast.

2) Choose any customized forecast from the list that displays, and select it to open.

3) You can select a statement and metric to filter the forecast using 'the funnel' icon, then select Apply.

4) Choose View detailed forecast to view your forecast in a grid format.

5) Select Profit and loss, Balance sheet, or Statement of cash flow to view each AI-generated forecast.

6) Choose About this forecast to learn more about how the forecast was generated. (Shown in the Red box below)

With this new Intuit Enterprise Suite reporting feature, you will stay on track and make better-informed decisions by converting your forecast into a budget.

Disclosures:

Feature content, including graphics, was adapted from Intuit media source content and other Intuit Enterprise Suite resources, including Help features. Content published by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, Intuit Enterprise Suite refers to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.