Thomson Reuters Launches AI Sales and Use Tax Compliance Solution

Thomson Reuters, a global content and technology company, has announced the launch of ONESOURCE Sales and Use Tax AI.

This launch underscores the Thomson Reuters commitment to transforming the compliance landscape. This powerful solution reclaims time, reduces audit risk, immediately provides ROI and cuts internal compliance cycles.

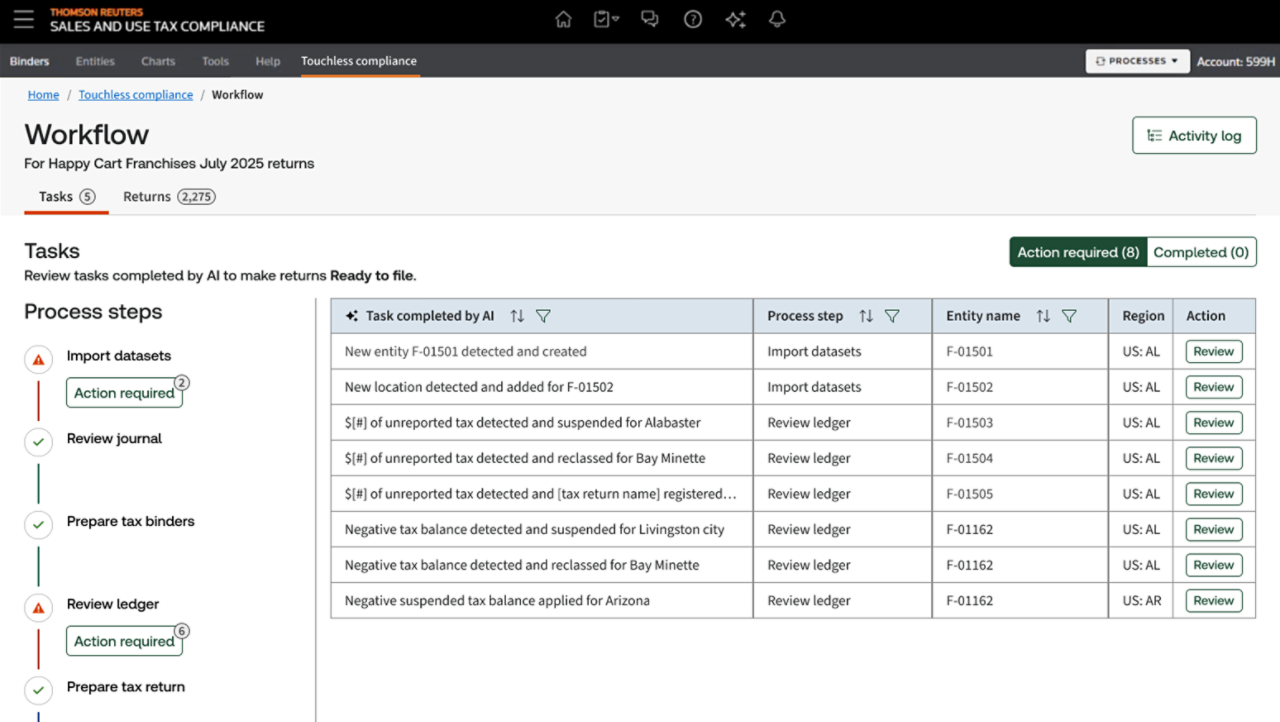

[Caption*: Automate data preparation, validation, and return filing, reducing manual steps by up to 50% and freeing your team for higher-value work. ONESOURCE AI streamlines every stage of compliance, allowing you to focus time on strategy instead of spreadsheets.]

ONESOURCE Sales and Use Tax AI delivers measurable impact from day one:

- Reclaims time: Reduces time spent on routine reporting by up to 65% – redirecting those hours to tax planning, strategy, and advisory work that drives business value.

- Reduces audit risk: Early customers report up to 75% reduction in audit exposure through automated validation and complete audit documentation.

- Proves ROI immediately: Small enterprises save approximately $25,000 annually in time and efficiency; large enterprises save $60,000 or more.

- Meets deadlines with confidence: Cuts compliance cycles from 30 days to 11 days for large enterprises, eliminating last-minute scrambles and overtime.

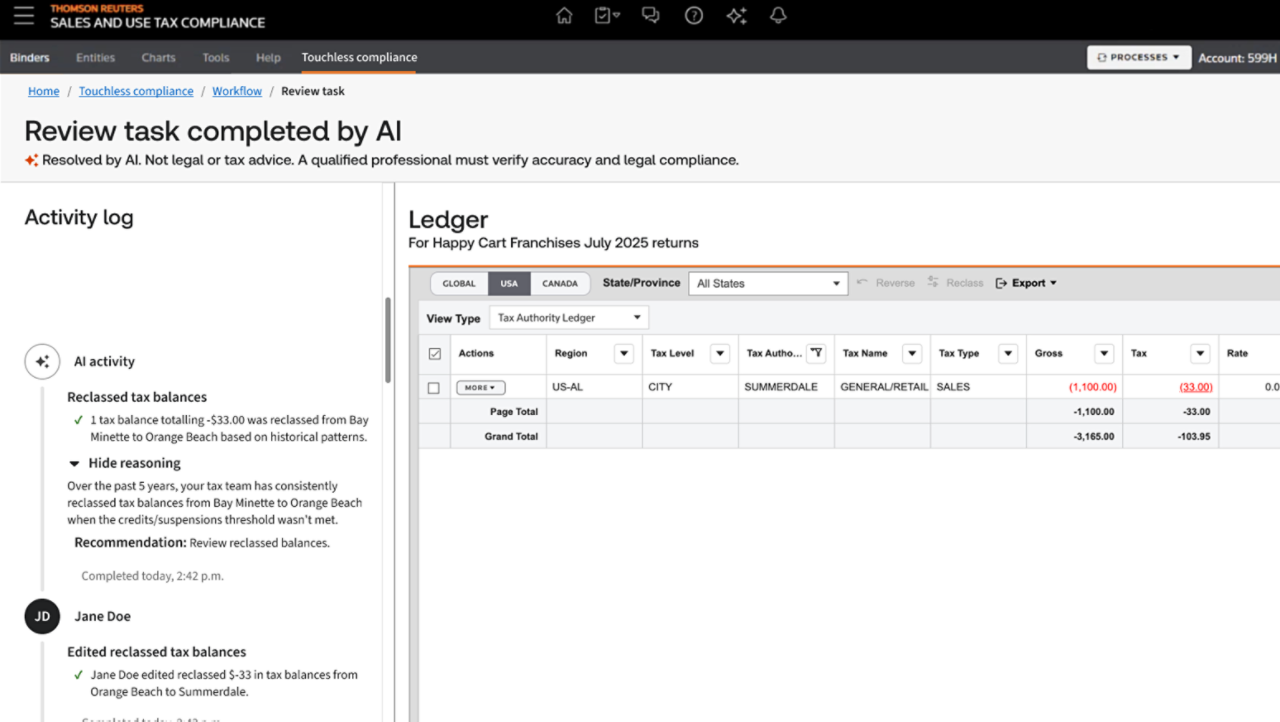

Powered by CoCounsel, ONESOURCE Sales and Use Tax AI introduces the Thomson Reuters vision of "Touchless Compliance" – where agentic AI accurately manages the heavy lifting of data import, validation, and tax return mapping. Tax professionals retain crucial oversight through final review and approval, but the reduction in manual intervention frees up their time for more high-value work. Professionals across more than 19,000 U.S. jurisdictions will be ensured accurate, on-time sales and use tax returns amidst an increasingly complex and manual operational environment.

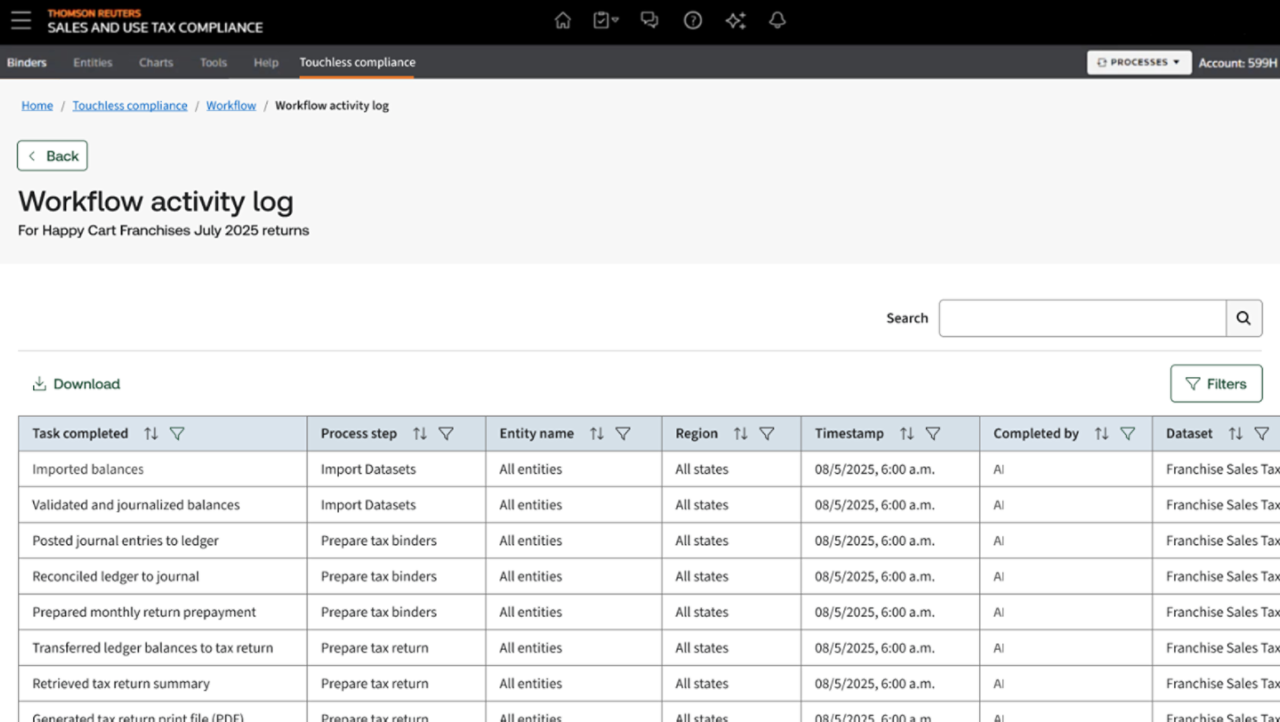

[Caption*: Make every action traceable and auditable to boost confidence in your filings and simplify audits. Proactive anomaly detection and compliance monitoring deliver daily insights, not just periodic reports, so you can act fast and stay ahead of risk.]

"At Thomson Reuters, our Corporates vision is clear – compliance should be touchless by default, manual by exception. This isn't just automation; it's a fundamental re-imagining of the tax function, freeing professionals to drive strategic business advantage," said Ray Grove, Head of Product, Corporate Tax and Trade, Thomson Reuters. "It's a testament to our relentless pursuit of innovation, trust, and deep customer understanding."

ONESOURCE Sales and Use Tax AI combines intelligent automation with the control tax professionals require:

- AI automation with the user in control: The automated workflow handles data transfer, validation, and mapping while users maintain final review and sign-off.

- Answers auditor questions instantly: Complete audit trails provide transparency and documentation for every automated decision.

- Comprehensive coverage: The solution provides access to more than 1,200 U.S. state, county, and city signature-ready official returns.

- Files directly from the platform: Electronic filing support in 33 states plus Canada eliminates manual submission.

- Always current, always accessible: Cloud-based access with automatic monthly content updates ensures users are always working with the latest forms and rates.

[Caption*: Connect enterprise resource planning (ERP) and business systems to create a unified, end‑to‑end compliance workflow without app switching. Configure review gates to balance automation with oversight and empower your team to intervene when needed.]

ONESOURCE Sales and Use Tax AI serves corporate tax departments across all organizational sizes, integrating seamlessly with Thomson Reuters broader indirect tax portfolio – including tax determination and calculation, certificate management, international VAT compliance, and e-invoicing – for an end-to-end solution that incorporates AI automation with the user in control, from transaction to filing.

{Caption*: ONESOURCE Sales & Use Tax AI offers secure, cloud-native access for any team, anywhere. Get automated monthly updates with vetted tax changes, covering more than 1200 returns across the U.S., Canada, and Puerto Rico, including over 100 local jurisdictions. It supports e-filing for 33 U.S. states.]

{Caption*: ONESOURCE Sales & Use Tax AI offers secure, cloud-native access for any team, anywhere. Get automated monthly updates with vetted tax changes, covering more than 1200 returns across the U.S., Canada, and Puerto Rico, including over 100 local jurisdictions. It supports e-filing for 33 U.S. states.]

ONESOURCE Sales and Use Tax AI is part of Thomson Reuters ONESOURCE+, the only intelligent compliance network connecting tax, trade, legal, and risk domains, and powered by Thomson Reuters professional-grade AI. It is available now for U.S. corporations and accounting firms with sales and tax obligations. For more information, please visit the Thomson Reuters Automate Tax Returns with ONESOURCE Sales & Use Tax AI webpage.

Disclaimer:

This feature was adapted from Thomson Reuters press announcement and related website content. Feature graphic images and captions* were adapted from the related Thomson Reuters website. Source materials were adapted by Insightful Accountant solely for educational purposes. Insightful Accountant is not responsible for any of the original content furnished by Thomson Reuters or published on their website.

Thomson Reuters® is a registered trademark of Thomson Reuters Corp (NYSE / TSX: TRI) with headquarters in Toronto, Ontario, Canada. Thomson Reuters informs the way forward by bringing together the trusted content and technology that people and organizations need to make the right decisions. The company serves professionals across legal, tax, accounting, compliance, government, and media. Its products combine highly specialized software and insights to empower professionals with the data, intelligence, and solutions needed to make informed decisions, and to help institutions in their pursuit of justice, truth, and transparency. Reuters, part of Thomson Reuters, is a world leading provider of trusted journalism and news. For more information, visit tr.com.

Other trade names appearing herein may be registered, trademarked, or otherwise held by their respective owners and are now acknowledged accordingly. They have been referenced for informational and educational purposes only.

This is an editorial feature, not sponsored content. This article is provided solely for informational and educational purposes. Publication of this article does not represent any form of endorsement by either the Author or Insightful Accountant.

Note: Registered Trademark ® and Copyright © symbols have been eliminated from most articles within this publication for brevity due to the frequency or abundance with which they might otherwise appear or be repeated. We attempt to credit all trademarked products or copyrighted materials within the respective article footnotes and disclosures.