Sage Introduces New Capabilities in Sage Intacct R4

Sage, a leader in accounting, financial, HR, and payroll technology for small and mid-sized businesses, has unveiled new functionality in Sage Intacct designed to help finance teams move from managing data to driving performance. These new features simplify operations, accelerate reporting, and empower finance teams to lead with accuracy, agility, and confidence.

With finance leaders under pressure to move faster and deliver more value, Edelman DXI research for Sage shows that 84% want to close the books faster, and 87% are seeking greater automation across AP and reconciliation workflows. The latest Sage Intacct updates address these needs with AI-powered intelligence that helps teams work smarter and make confident, data-led decisions.

Alongside these innovations, Sage is taking steps to make AI more transparent and accountable. The Sage AI Trust Label, now live in Sage Intacct in the US and UK, gives customers clear insight into how AI is developed and applied, including how data is used, the safeguards in place to prevent bias, and the measures taken to ensure accuracy and compliance.

“This release is about giving finance teams more automation and insight powered by AI” said Dan Miller, EVP, Financials & ERP Division, Sage. “We’ve embedded AI into the close and announced the Finance Intelligence Agent. We’re helping customers anticipate issues and act faster. By orchestrating data and responses from multiple AI Agents within Intacct, finance teams can go from question to answer in seconds — no reports, no manual analysis. These innovations reflect Sage’s commitment to building practical, connected AI that delivers measurable outcomes for every finance leader.”

Driving the Next Era of High-Performance Finance

From AI-driven variance analysis and real-time reconciliation to automated consolidations, connected insurance data, and a growing network of intelligent Agents, Sage Intacct continues to deliver on its vision for High-Performance Finance, helping customers simplify complexity, improve control, and accelerate growth.

These Agents - including Close, AP, Time, Assurance, and the newly announced Finance Intelligence Agent - work together to automate repetitive tasks, surface insights in context, and provide finance leaders with continuous visibility across their operations. Together, they represent a significant step toward autonomous finance, where insights and actions flow seamlessly across the business.

As Sage advances this vision, partners and customers are already seeing how these innovations bring new levels of visibility and confidence to financial operations.

“Sage continues to raise the bar for what finance teams can achieve with intelligent automation,” said Matt Rowley, Partner – Service Line Leader, Wipfli. “With innovations like AI-powered Close Automation and Sage’s expanding network of AI Agents, customers are gaining faster insights, greater accuracy, and the freedom to focus on high-value work.”

What’s New in Sage Intacct R4 2025

Close Automation with Sage Ai

Close Automation with Sage Ai is now generally available for all customers in the US and UK, bringing together the full suite of intelligent close capabilities - Close Workspace, Close Assistant, Subledger Reconciliation Assistant, and Variance Analysis – all in one connected, Sage Copilot-guided experience. The solution provides visibility across teams, tasks, and entities, helping finance leaders identify issues early, shorten close cycles, and improve accuracy and auditability. Close Automation with Sage Ai is now available to customers in the US and UK.

Finance Intelligence Agent

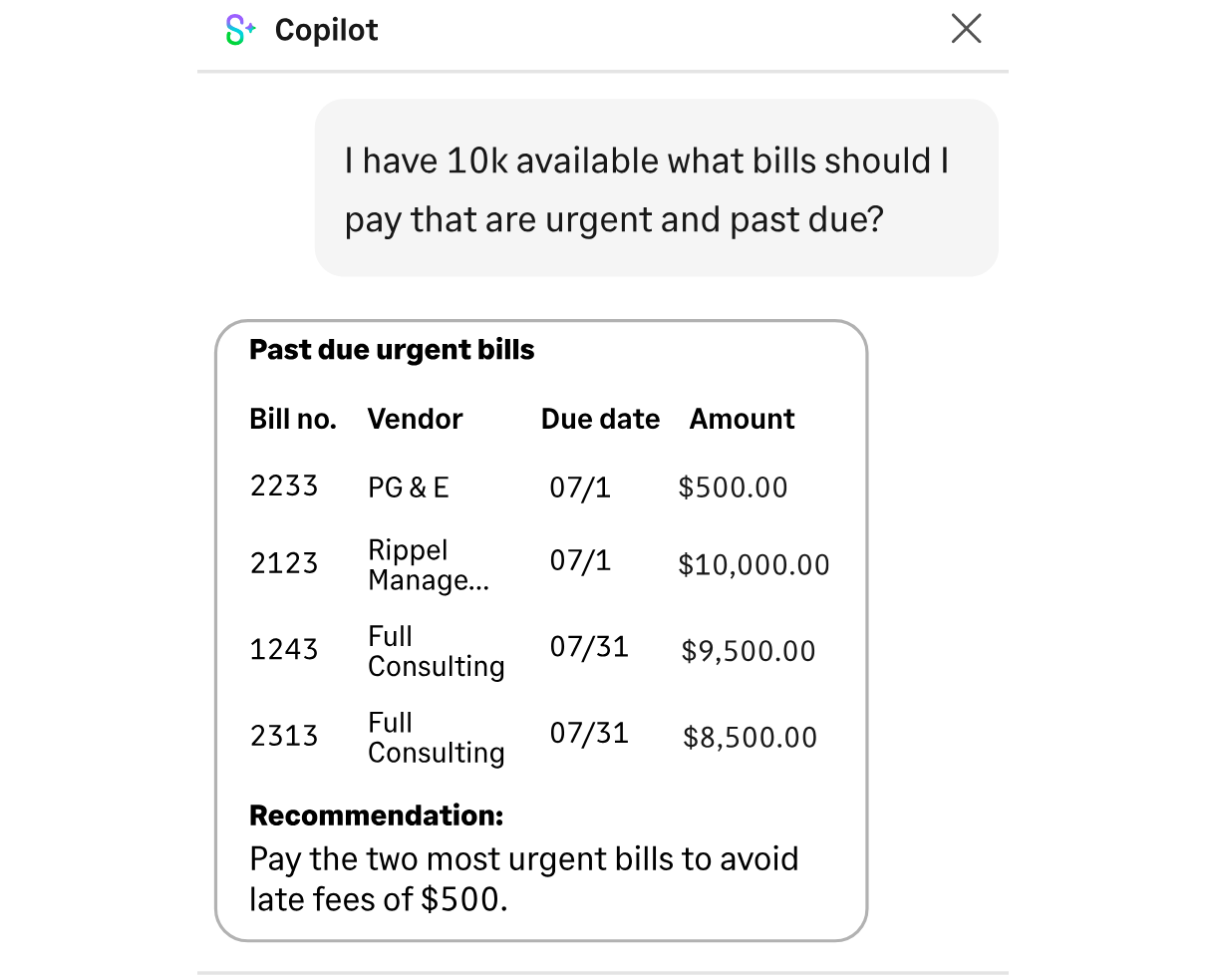

The Finance Intelligence Agent is the newest addition to Sage Intacct’s growing network of AI Agents, delivering autonomous insights alongside existing Close, Accounts Payable, Time, and Assurance Agents. It allows finance teams to ask questions in natural language through Sage Copilot and receive instant, actionable answers – transforming how they access, analyze, and act on data.

The Finance Intelligence Agent is available by 'early access' to customers in the US and UK from December

Equity Method for Advanced Ownership Consolidation

The new Equity Method for Advanced Ownership Consolidation automates equity accounting for complex, multi-level ownership structures, including partial ownership and multi-parent roll-ups. By automatically generating and recording equity entries during consolidation, finance leaders gain transparency, precision, and flexibility with affiliate-level reporting across multiple entities. Equity Method for Advanced Ownership Consolidation is now available to customers in the US, UK, Australia, Canada, and South Africa.

Sage Intacct PolicyConnect

Sage Intacct PolicyConnect seamlessly integrates policy administration systems with the general ledger, giving insurance organizations a unified view of operational and financial data. This connection enables deeper analysis of profitability, exposure and performance, delivering real-time policy level data to accelerate reporting and provides actionable insights to stakeholders. Sage Intacct PolicyConnect is currently available to customers in the US.

AI Trust Label Now Live in Sage Intacct

The Sage AI Trust Label is now live in Sage Intacct in the US and UK, giving customers greater transparency and confidence in how AI is developed and used. It provides clear, accessible information on Sage’s responsible AI practices, including compliance, data use, safeguards against bias, and accuracy monitoring — helping businesses build trust and confidence in AI-powered finance. AI Trust Label is now available to Sage Intacct customers in the US and UK.

Sage Expense Management

Sage Expense Management, formerly Fyle, simplifies and automates expense workflows with real-time spend notifications and AI-powered receipt capture and matching. The card-agnostic solution lets organizations retain existing credit-card programs while gaining instant visibility into spend, helping finance teams control costs, improve accuracy, and close faster. Sage Expense Management is presently available to Sage Intacct customers in the US.

Disclaimers:

Content (including graphic material) furnished by Axicom Communication on behalf of Sage, and is published with minimal alterations. Insightful Accountant is not responsible for any of the original Sage content material provided within this article.

This feature references one or more registered trade names or trademarks of the Sage Group PLC (SGE.L) on the LSE, located in Newcastle upon Tyne in the United Kingdom, may appear within this content.

Sage exists to knock down barriers so everyone can thrive, starting with the millions of Small and Mid-Sized Businesses (SMBs) served by us, our partners and accountants. Customers trust our finance, HR and payroll software to make work and money flow. By digitizing business processes and relationships with customers, suppliers, employees, banks and governments, our digital network connects SMBs, removing friction and delivering insights. Knocking down barriers also means we use our time, technology and experience to tackle digital inequality, economic inequality and the climate crisis.

Any other trade names or entities mentioned within this article may refer to products registered, trademarked, or otherwise held by their respective owners. They are referenced solely for informational and educational purposes.

This feature is "not" sponsored content. The article is provided for informational and educational purposes. The publication of this article does not represent an endorsement by either the author or Insightful Accountant.

Note: Registered Trademark ® symbols have been eliminated from the articles within this publication for brevity due to their frequent occurrence. We attempt to credit such trademarked products within our respective article footnotes and disclosures.