The insurance you offered to S Corp 2% (or higher) shareholders as well as the rest of your employees determines the tax treatment for S Corp insurance. It also determines how you set up this non-cash fringe benefit in QuickBooks Desktop payroll.

To learn more about the treatment of insurance for S Corps, review IRS Notice 2008-1.

Depending on the insurance plan made available to S Corp 2% (or higher) shareholders, you can set up an appropriate payroll item in QuickBooks Desktop payroll to track and report the information for tax purposes.

1) If the 2% (or higher) shareholders have the same medical insurance plan offered to all S Corp employees, the plan is subject to federal and state withholding, but exempt from Social Security, Medicare, and FUTA.

2) If the 2% (or higher) shareholders have a different plan from other S Corp employees or the S Corp doesn't offer an insurance plan to employees at all, the plan is fully taxable.

Setting up S Corp 2% (or higher) Shareholder Insurance

There are 2 tax tracking types for S Corp Shareholder Insurance, depending on the plan offered to the 2% (or higher) shareholders and other employees. The 2 tax tracking types are directly related to the 2 type of offerings defined above. The set-up below is directly related to the two insurance offering types.

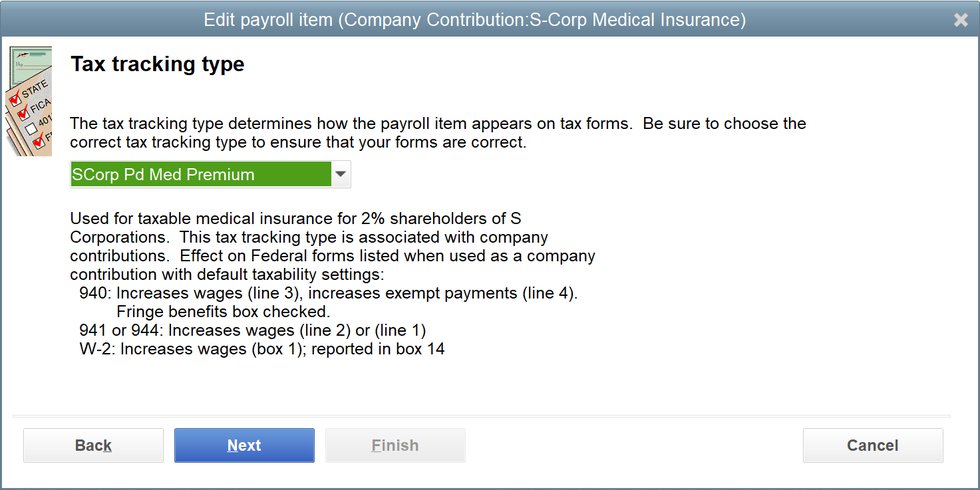

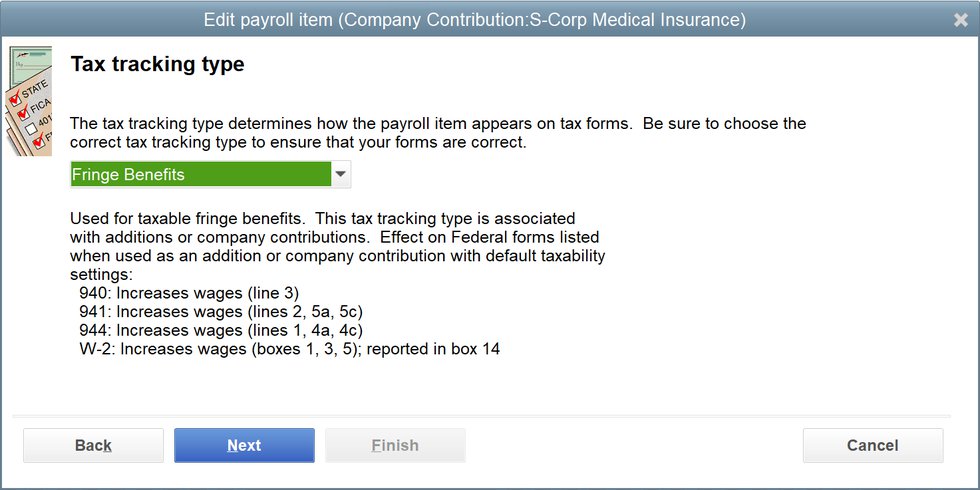

The Tax treatments of each type are shown in the QuickBooks Payroll Item illustrations below.

1) SCorp Pd Med Premium - this tax reporting type is used when the 2% (or higher) shareholder receives the same medical insurance plan as all other all S Corp employees. Under this configuration, the benefit is only taxable to federal and state withholding. Exempt from Social Security, Medicare, and FUTA.

2) Fringe Benefits - this tax reporting type is used when 2% (or higher) shareholders have a different plan from other employees or don't offer the plan to employees at all. This is fully taxable.

Disclosures

Feature content, including graphic materials were adapted from Intuit source content. Content created or otherwise adapted by Insightful Accountant from Intuit source content is furnished for educational purposes only.

As used herein, QuickBooks®, QuickBooks Enterprise, and QuickBooks Desktop Payroll, refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.