New Employee Cost Rate Feature helps track Project Payroll Costs

Project-based QBO customers can now track project profitability more closely using a new employee 'cost rate' feature without having to reply on third-party or manual solutions like spreadsheets.

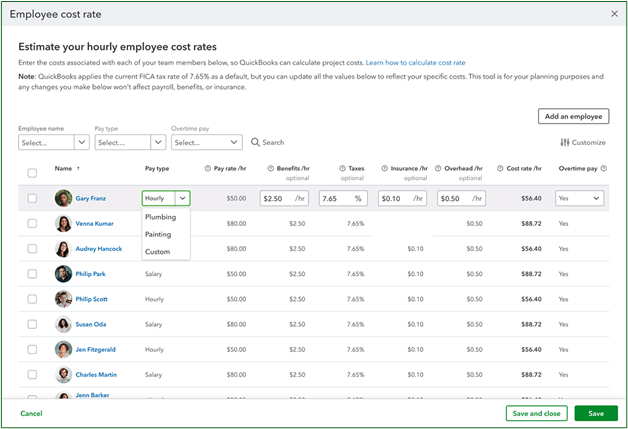

QBO Plus and Advanced subscribers using QuickBooks Online Payroll can now use a new cost rate calculator that provides entry fields for common factors, including pay rate, benefits, taxes, insurance, and overhead expenses.

The new cost rate calculator will automatically populate employee pay types and rates from QuickBooks Online, and also convert salary amounts to hourly rates for cost computation. It typically defaults to the standard FICA rate (7.65%) when computing taxes for U.S. subscribers. Presently, the new cost rate calculator doesn't computer overtime costs as part of rate computations.

Once employee cost rates have been computed by the new calculator, they will be automatically applied to any employee time events added to Projects.

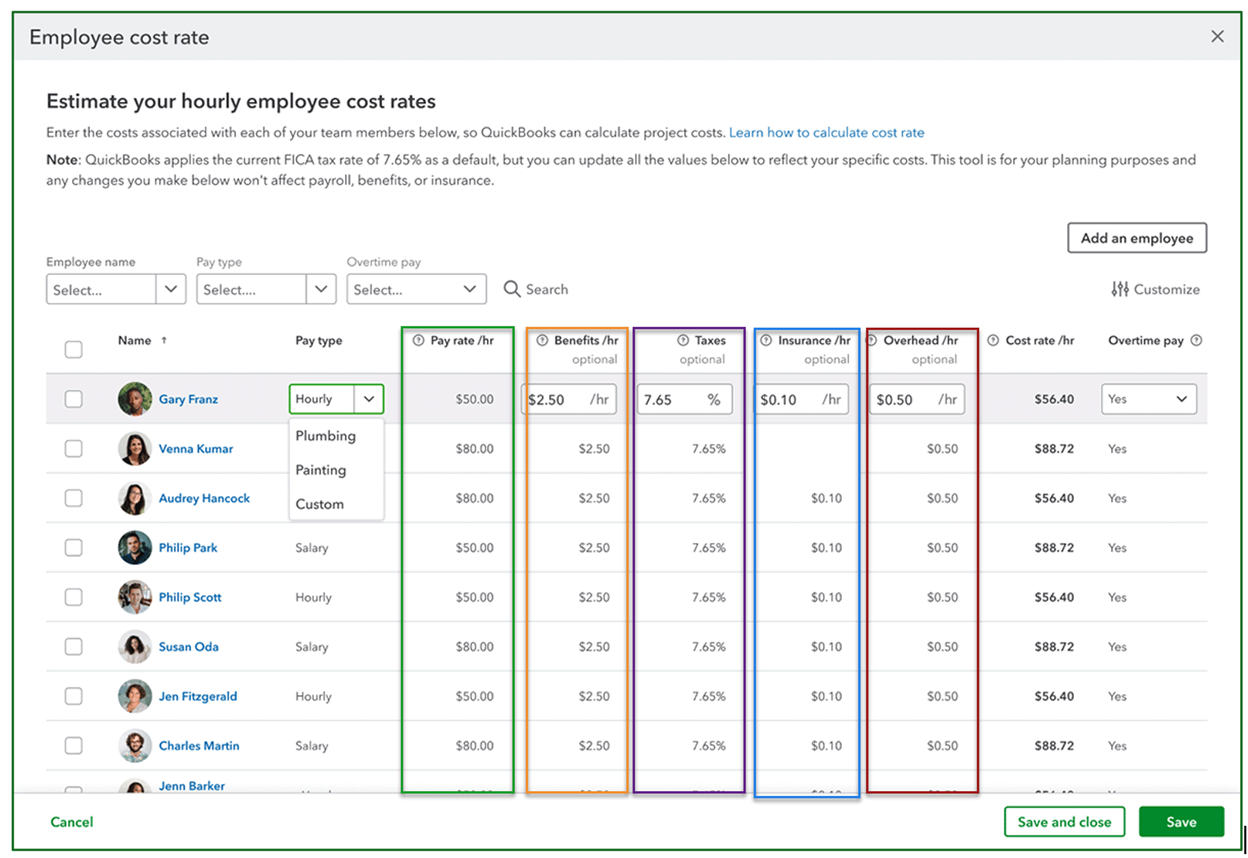

In case you are wondering what 'cost rates' are, a cost rate represents the total cost of an employee to a business.Typically this rate will include pay rate, benefits paid by the employer, insurance paid by the employer, taxes paid by employer, and overhead amounts related to employees.

The new calculator allows users to manually enter employee pay rates; however, if you previously added cost rates for employees in QBO Payroll, those rates will carry over into the new rate calculator. Similarly, the amounts you enter into the cost rate estimator tool for employees will be added to the cost rate for those employees in QBO Payroll, they will also be used to calculate employee time costs for Projects.

Using the Cost Rate Estimation Tool

This tool helps you estimate your hourly employee costs with the common factors that contribute to the total cost for an employee. Remember, the cost rate is the employer's cost; therefore, any costs the employee pays should be excluded.

The cost rate estimator tool calculates the cost rate as a per-hour amount. All amounts entered into the estimator should be on an hour basis, excluding taxes, which are entered as a percentage. Step-by-step instructions for entering cost rate data manually, or from QBO Payroll are described further below.

Factors Contributing to Employee Total Cost Rate

- Pay rate – Shown in the Green Box below. The amount the employer pays an employee for a specified amount of time (also known as a wages). For hourly workers, the pay rate is their wage per hour. For salaried employees, the pay rate is calculated by month or year.

- Benefits - Shown in the Orange Box below. The amount the employer pays for a worker's employee benefits, like health insurance (including medical, dental, vision, life insurance) and 401(k).

- Taxes - Shown in the Purple Box above. The amount you pay in taxes to employ the worker is calculated as a percentage. This amount is defaulted to the standard tax that includes the employer match for Social Security and Medicare taxes.

- Insurance - Shown in the Blue Box above. The amount you pay for insurance to employ the worker. For example, you may include general liability or workers' compensation insurance costs.

- Overhead - Shown in the Red Box above. The amount you pay for other expenses that you want to factor into your costs. For example, you may include costs associated with uniforms, equipment, mobile devices, or training.

To Manually Enter Cost Rates

- Go to Projects.

- Select Manage settings,

- Then choose Set cost rate.

- Find the employee you need to work with,

- Enter the Employee's details (Pay rate, Benefits, Taxes, Insurance, and Overhead).

- The cost rate will automatically calculate, choose Save.

To Enter Cost Rates from Payroll

- Go to Payroll,

- Choose Employees.

- Select the employee you need to work with.

- Choose Edit within Employment details.

- Select the pencil icon ✎ to edit cost rate.

- Enter the employee's details (Pay rate, Benefits, Taxes, Insurance, and Overhead).

- The cost rate will automatically calculate, choose Save.

Disclosures:

Content is based on Intuit source materials including media source content from Intuit websites. Intuit content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, QuickBooks®, QuickBooks Online (and related subscription/SKU versions) and QuickBooks Online Payroll refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Note: For reference purposes, the feature headline graphic is an AI-generated image, it does not, nor is it intended to, reflect either QuickBooks or the new QuickBooks feature.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.