More About What's New in the New QBO Accounting Agent

Even before its release, we began exploring the New QuickBooks Online which went live (by optional 'opt in') on July 1. This past Monday Minute began a deeper look into the Accounting Agent that assist with bookkeeping and accounting tasks including banking transactions and more.

In today's feature we want to examine Anomaly Detection and Accountant-Client Issue Clarification features that the Accounting Agent facilitates. We will also look again at the timeline for Intuit's transition from the current 'Classic' product to the new 'AI Driven' experience.

Anomaly Detection

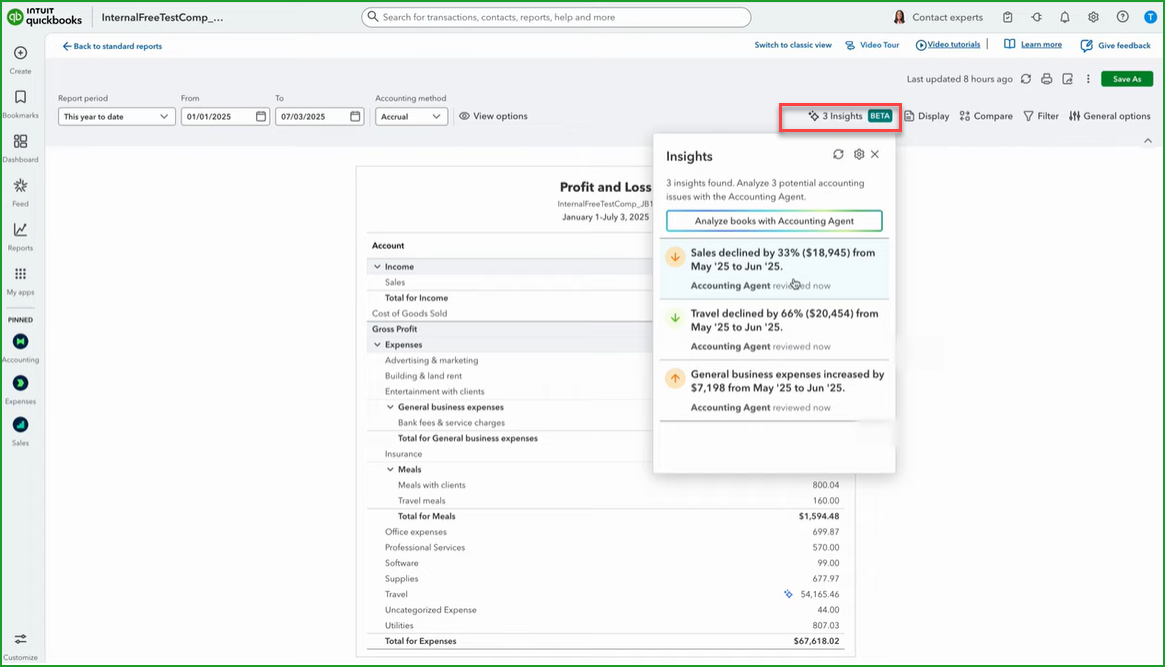

The Accounting Agent is also able to identify outlier data and other potential errors, including miscategorizations. Anomaly Detection can initially be found on both Profit & Loss or Balance Sheet reports. The Report header now features a new 'Beta' option called Insights (highlighted in the red box below). When you click on Insights, a summary of potential issues appears, providing additional information.

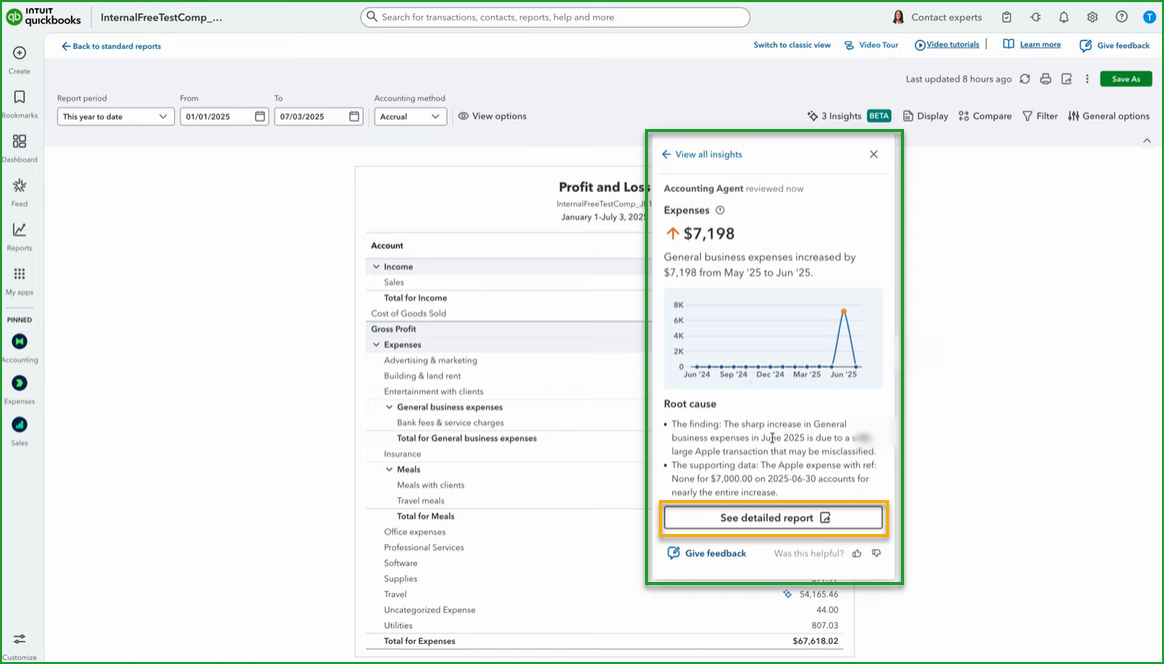

By clicking on any of the Insights listed, you get an explanation of the Accounting Agent's findings (shown in the green box below).

As if that wasn't sufficient, Agentic AI is ready to provide you with a 'detailed report' simply by clicking the See detailed report button at the bottom of the insight (highlighted in the yellow box above). The Detailed Report (shown below) provides both an issue summary and a detailed analysis of the outlier.

This 'agentic' function has the potential of saving significant time in looking for and tracking down problems that appear during the 'Book Review' phase of period-end. Yet, even though the Artificially-intelligent agent is "sniffing out the issues", the QuickBooks user still has ultimate control over the resolution of the problem(s).

Accountant-Client Issue Clarification

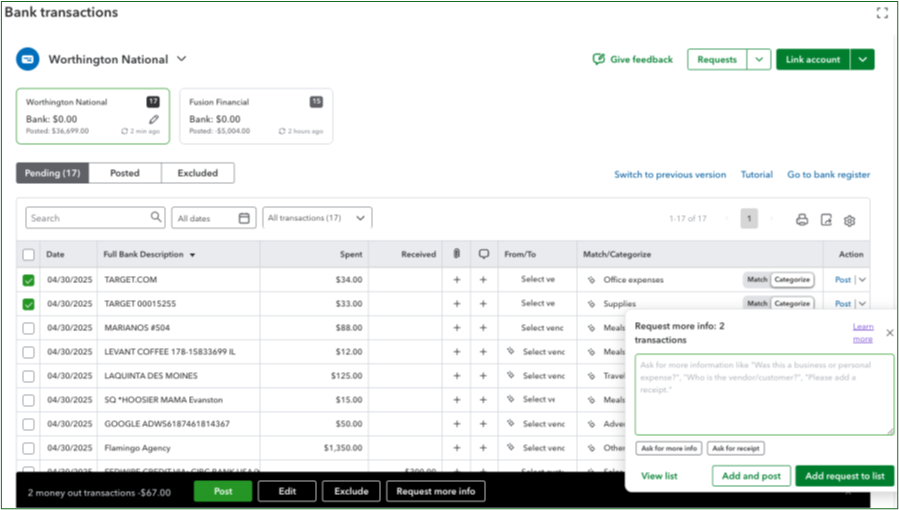

When issues arise from Anomaly Detection, your review of Monthly Reports (like the P&L or BS), or even during transaction categorization or bank reconciliation, the new Accounting Agent enables accountants to request information directly from clients on transactions between most QBO SKUs and QuickBooks Online Accountant, utilizing AI-enabled information gathering from the client.

In the example shown above, the Accountant needs to clarify information related to proper categorization of a transaction. The new Accounting Agent makes identification of such transactions simple and then allows the Accountant to send the Client a request for more information using either common 'quickfill' messages, or by asking their own before the transaction is posted.

Accountants are also provided with settings that enable them to define when and how both their requests and the client's responses flow within the system between themselves and their clients. These requests can be sent through Intuit email or your preferred method by copying the "magic link" into an SMS messaging app, Teams, Slack, or another email account. Clients receiving the link can access the Accountant's request via mobile or web.

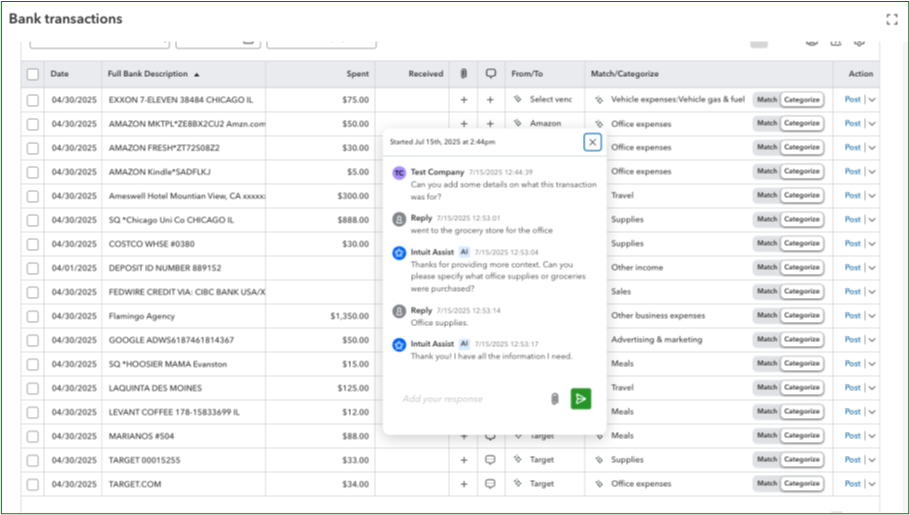

The Accounting Agent monitors the status of all requests and notifies the Accountant when the client responds. A conversation record (as shown above) between the Accountant and the client is captured and stored as part of the transaction, permitting the Accountant to later review the history. Simultaneously, category and matching suggestions are updated based on the additional context gathered from the client.

Transitioning to the New QBO

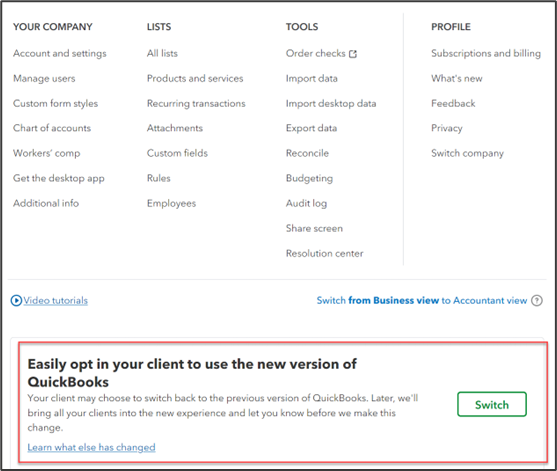

As of July 1, the New QBO is here, and AI Agents are already fast at work. Between now and August 1, existing QBO subscribers in the United States can manually opt into the new experience (as shown in the settings section of the illustration below) or remain on the current version of QuickBooks.

Between August 1 and 31, 2025, subscribers who have taken no action will be automatically opted in, with the option to opt out before September 1–30, 2025.

From September 1 to 30, 2025, all subscribers will be automatically opted into the new experience. By the end of September 2025, all subscribers will be upgraded to the new platform experience, and the prior version of QuickBooks Online will no longer be available.

Now is the time to adjust slowly, opt in and give a few things a try, then opt back out for things as usual for a while, and keep doing that until you find that it just takes a little "getting used to" but it's all going to be OK. Come October 1st, you will likely not even remember "the way it was." (Murph)

Footnotes and Disclosures:

Feature content, including graphics, was adapted from Intuit media source content and other QuickBooks resources. Some content is based on pre-release QuickBooks (Online) Advanced Beta version of the New QBO experience, along with pre-release notes, and other Intuit source materials.

Content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, QuickBooks® and QuickBooks Online (and related subscription/SKU versions) refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.