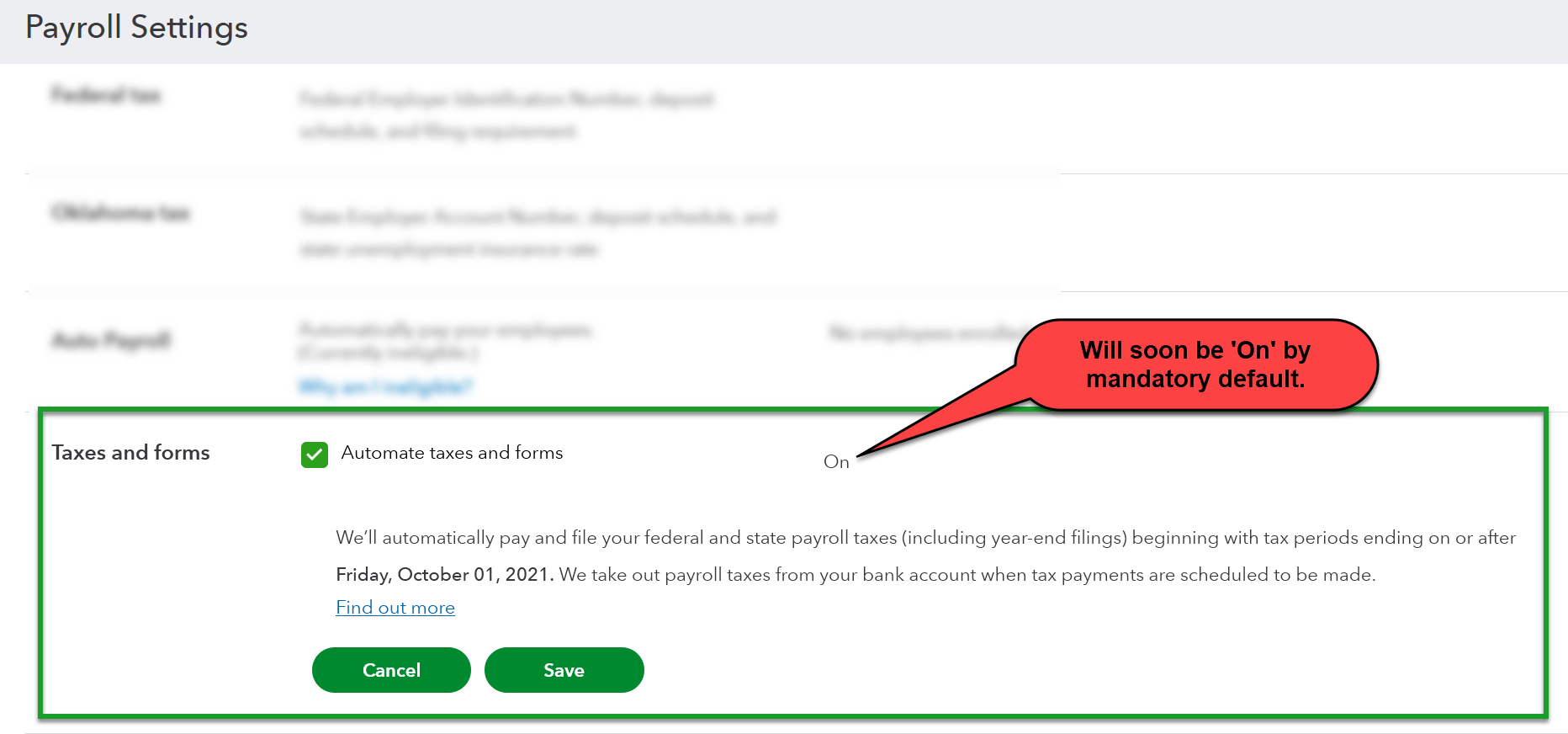

Intuit has just announced that on or before November 15, 2025, all new QuickBooks Online Payroll subscribers will have the Automated taxes and forms feature setting enabled as a mandatory setting.

With this setting engaged by default, QuickBooks Online will calculate, pay and fill all payroll taxes automatically once a customer has completed payroll tax setup. Intuit will then withdraw funds securely every time a payroll is run, or tax liabilities increase, and all tax payments will be available to subscribers within their Payroll Tax Center. Intuit will also assume responsibility to file and pay taxes by the due dates to ensure that subscribers remain payroll tax compliant.

In making the announcement, Intuit appears to be saying that this change comes about as a result of accountants who would prefer to be performing increased advisory services as opposed to 'compliance' services centered around payroll taxes including tax remittances and reporting. Reportedly, this update to 'mandatory automatic taxes and forms' will help ensure that payroll subscribers are continually compliant without any need to worry about making payroll tax payments, or preparing reports on their own.

For more information, see this official Intuit 'Changes to Payroll' webpage'.