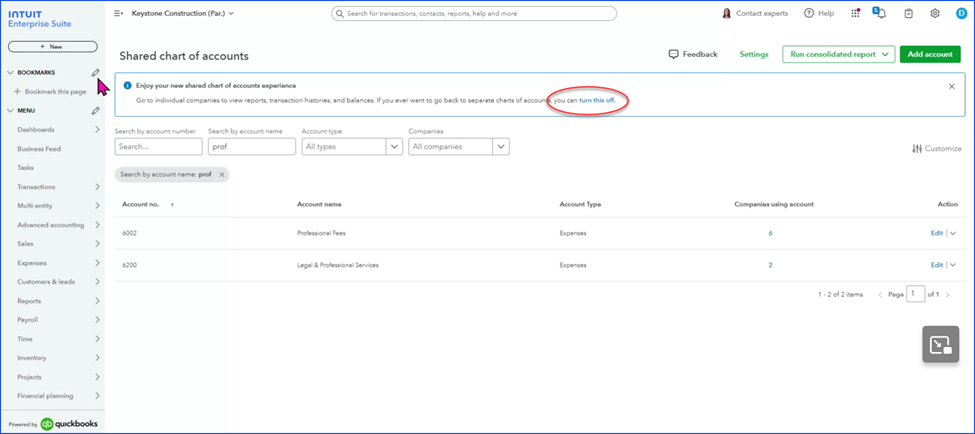

Intuit Enterprise Suite - Shared Chart of Accounts

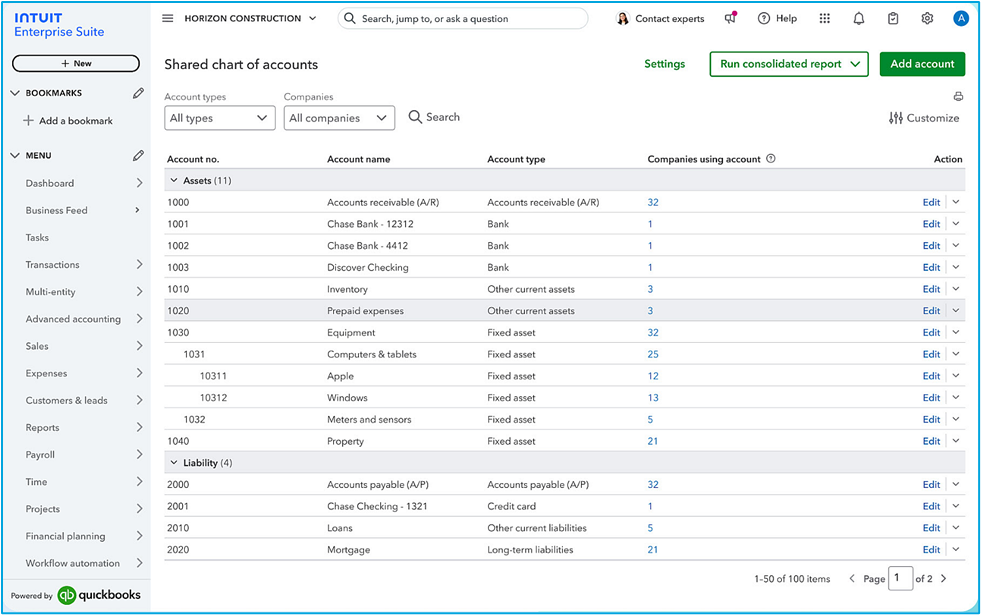

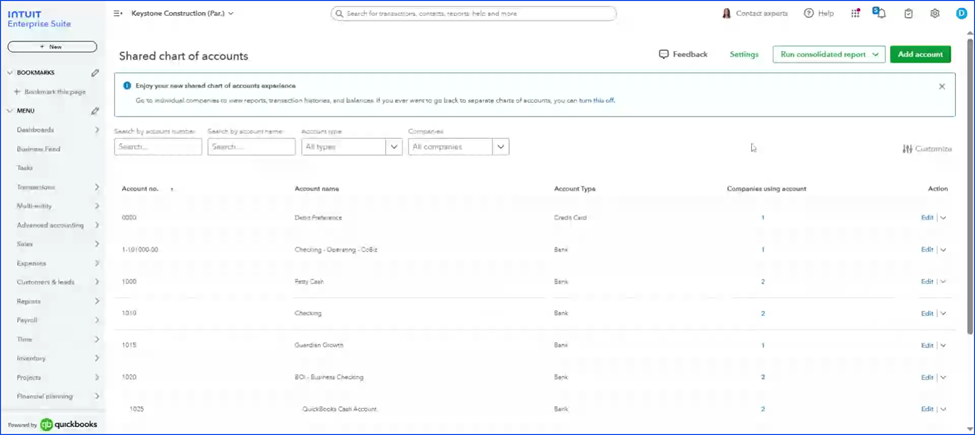

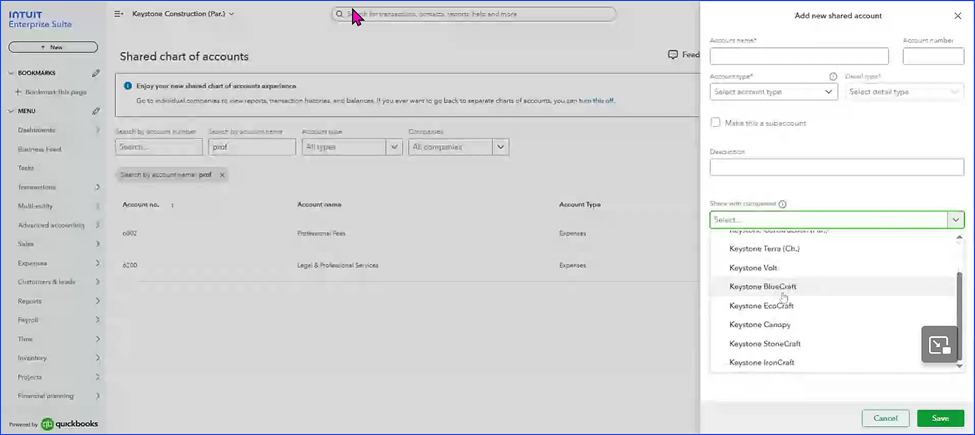

In the Summer 2025 feature release to Intuit Enterprise Suite, Parent Company Administrators now have the option of a Shared Chart of Accounts. This new feature allows the Parent Company Administrator to standardize and manage the Chart of Accounts for multiple related entities from a single interface.

The process of using a Shared Chart of Accounts involves mapping individual entity accounts to a shared, standardized chart, which helps with financial reporting, streamlines intercompany transactions, and provides real-time financial visibility across all entities within the suite. Intuit is providing an AI-driven tool to assist Parent Company Administrators in mapping their subordinate entity Charts of Account to the centralized Shared Chart of Accounts.

Why Multi-entity Businesses Should Use a Shared Chart of Accounts

There are at least five reasons why multi-entity businesses should use a Shared Chart of Accounts:

- Efficient Data Management: Enables control and management of the Chart of Accounts across all related entities from a single interface.

- Enhanced Visibility: Provides real-time, multi-entity visibility into financial performance through a central hub.

- Streamlined Intercompany Transactions: Facilitates and streamlines intercompany transactions and allocations for better accuracy.

- Automated Eliminations: Supports the automated generation of supporting consolidated financial statements with native reporting within the suite.

- Standardized Reporting: Ensures consistency in financial reporting across all entities by using a standard chart of accounts.

Using the Intuit Enterprise Suite Shared Chart of Accounts

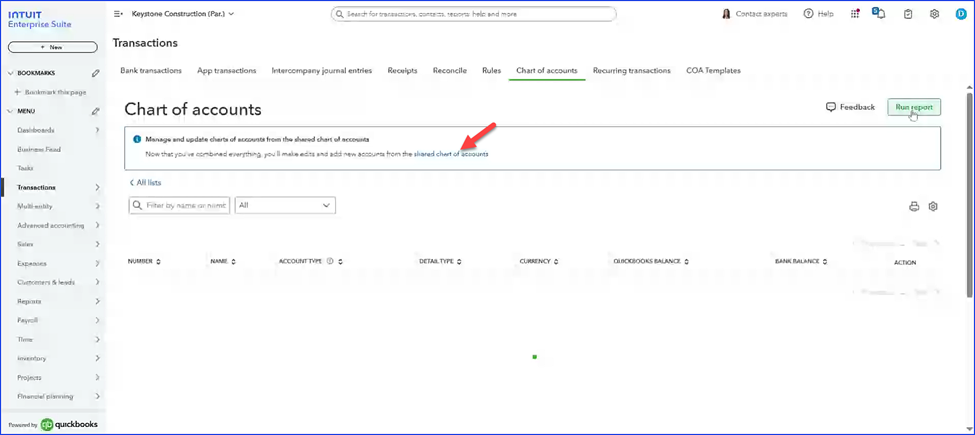

- Access the Dashboard - From the parent company's dashboard, navigate to Settings and select 'Shared Chart of Accounts'.

- Start the Process - Select Get started on the landing page to begin creating or managing the Shared Chart of Accounts.

- Review and Map Accounts - IES will display the Chart of Accounts standardization, showing how the accounts were mapped.

-

- Expand each account type (assets, liabilities, income, and expenses) to review their associated accounts and mappings.

- To un-map or change an account mapping, select the More options.

- Approve Changes - Once you've reviewed and are satisfied with the standardization settings, select Approve changes.

- Monitor Progress - IES will notify you when the process is complete, and you can view balances to see how the standardization will affect each company's financial reporting.

Nothing prevents you from turning-off the Shared Chart of Accounts. When you do, each entity, Parent and subordinates return to their prior individual Charts of Account. In addition, there is nothing that requires you to include all of your subordinate entities in the Shared Chart of Accounts, you can select, on an account by account basis which subordinates are associated with each account in the Shared Chart of Accounts.

Disclosures:

Feature content, including graphics, was adapted from Intuit media source content and Intuit Enterprise Suite resources including on-line Help. Content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein,Intuit Enterprise Suite refers to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.