There are numerous reasons why you might need to manually edit Payroll Liabilities in QBO, including Payroll Credits, Penalty & Interest, Late Filings and many others. At other times, it just becomes necessary to process Payroll Liabilities manually. What brought this topic and article to my mind was a recent experience with one of my clients.

Case-N-Point: Liability Credit

One of my clients was issued a credit for State Withholding. Here are the steps I used to enter the credit in QBO Payroll Essentials.

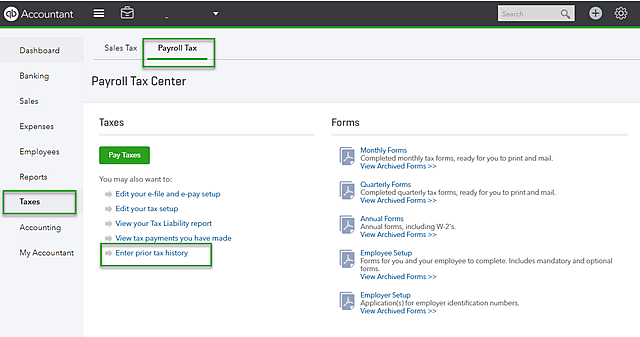

1. Navigation Bar > Taxes > Payroll Taxes > Enter Prior Tax History

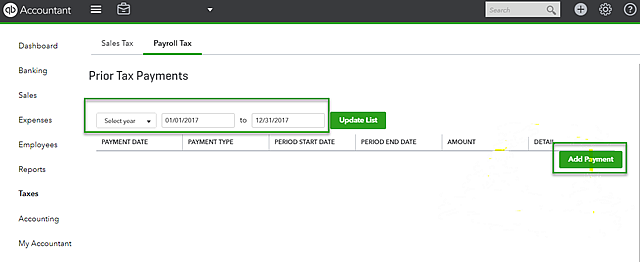

2. Select Current Year and Liability Period

3. Add Payment

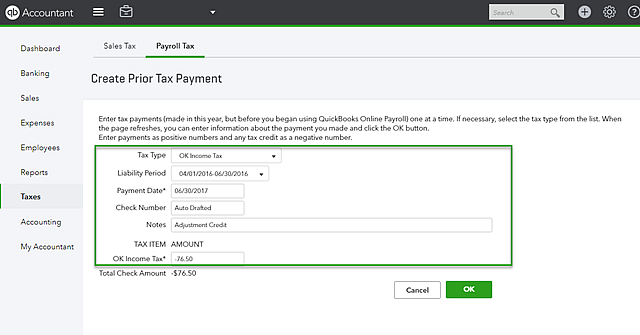

4. Select Tax Type (in this case it was a State Credit, so I would select State)

5. Enter Liability Period

6. Enter Payment Date

7. Enter Check Number and Notes

8. Create a Credit by entering a "Negative Amount"

9. Click the green "OK" button when you have entered all necessary information

That's it folks. Verify the next liability amount by confirming your adjustment was added to the payroll.

Other Reasons for Adjustment: Late Payment or Penalty/Interest

In either of these cases use this procedure:

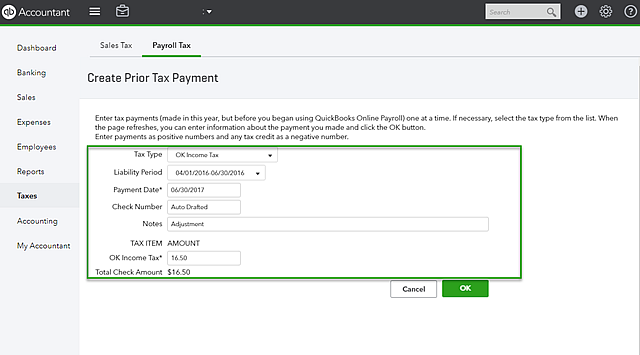

1. Follow steps 1 through 7 above

2. Instead of creating a credit by posting a "negative amount" (as in Step 8 above), enter a "positive amount," which creates an additional payment made outside of QBO payroll

3. When you have entered all the necessary information, click the green "OK" button

These really are pretty simple steps to follow on the few occasions when you need to make a manual payroll liability adjustment. With that said, remember that the above steps are only for use with QuickBooks Online Payroll Essentials.

If you have QBO Full Service Payroll, you must work with your QBO Full Service Rep and provide him with details regarding the payroll adjustment so that he can make the needed changes for you.