Fixing Past Quarterly Payroll Periods in QuickBooks Online Payroll

Murph looks at the recently enhanced process for fixing payroll errors in past quarterly (or year-end) periods when using QBO Payroll.

Do you ever find yourself needing to fix a past payroll from a prior Quarterly Payroll Period, or perhaps even the Year-end?

If you've had this issue before now you know that you had to contact QBO Payroll Support and wait, and wait, and wait, and wait some more for them to figure out the issue, work to resolve it, and then follow-up with any tax amendments that were required.

Now, you can avoid all that waiting, and make those corrections within QBO if you are using Core, Premium, or Elite QuickBooks Online Payroll*. As part of the correction process, Premium and Elite subscribers with "automated taxes and forms" active, can trigger the tax amendments process using the Payroll Care team at the conclusion of actual corrections.

That's what I said. With these recent changes, authorized Payroll users can void checks or direct deposits, edit checks when they have underpaid or overpaid employees, failed to record a paycheck, or need to make changes to employee or company contributions from a pay period. These same changes allow you, the authorized Payroll user, to perform many of the steps needed to accomplish these tasks before any involvement by the QuickBooks Customer Care team.

If needed, you can void a paycheck that you can’t otherwise adjust. You can edit a paycheck if you need to subtract pay from the pay period. If you need to add pay to an employee’s paycheck, you will most likely need to create a new paycheck for the period. In each of these cases, your tax liabilities will almost certainly change, and you will need to amend your tax reporting.

You should always make all necessary corrections for a pay period before you initiate any tax liability amendment. Core, Premium, and Elite QBO Payroll subscriptions support the making of such corrections; however, only Premium and Elite subscribers with ‘automated taxes and forms’ active have an option for amendments to be done for them by Intuit.

All QuickBooks Online Payroll Core subscribers must prepare their own amendments and pay taxes directly to the tax agencies. Such subscribers may wish to contact their accountant or a payroll tax preparer to assist them with the appropriate amendments. When amendments are made and additional tax liabilities are paid, it is important to ensure that these payments are marked as paid in the Payroll Tax Center.

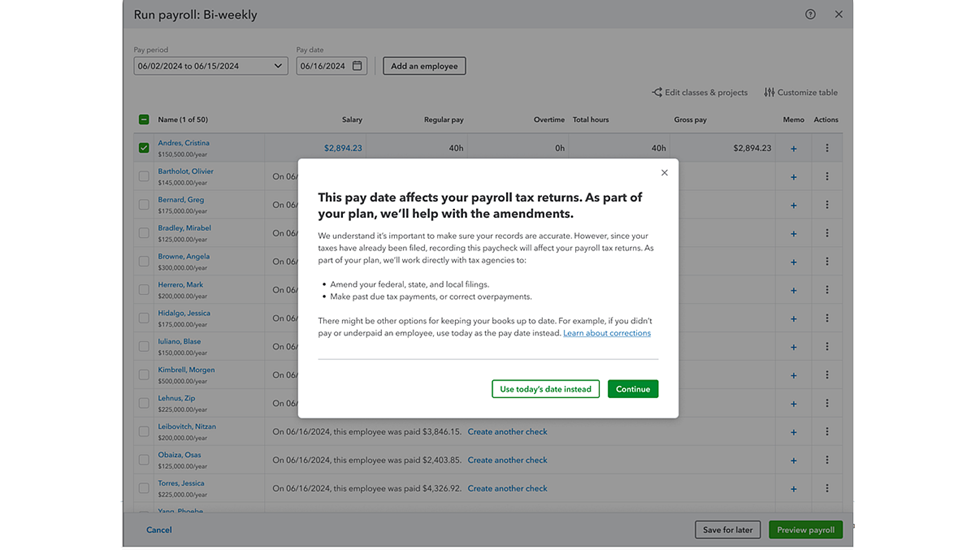

As mentioned above, if you are using QBO Premium or Elite subscriptions with ‘automated taxes and forms’ active, preparation of amendments is part of your payroll plan. In such cases, after you complete the prior period corrections in QuickBooks, you will be asked if you would like Intuit to make the amendments.

When you select ‘Continue’ to the question, as shown above, you will be asked how you want Intuit to handle your amendments and books (financial reporting). Since the adjustments impact your tax liabilities for a past payroll quarter or possibly a past payroll year, you need to recognize the potential tax implications and authorize the steps to be undertaken on your behalf.

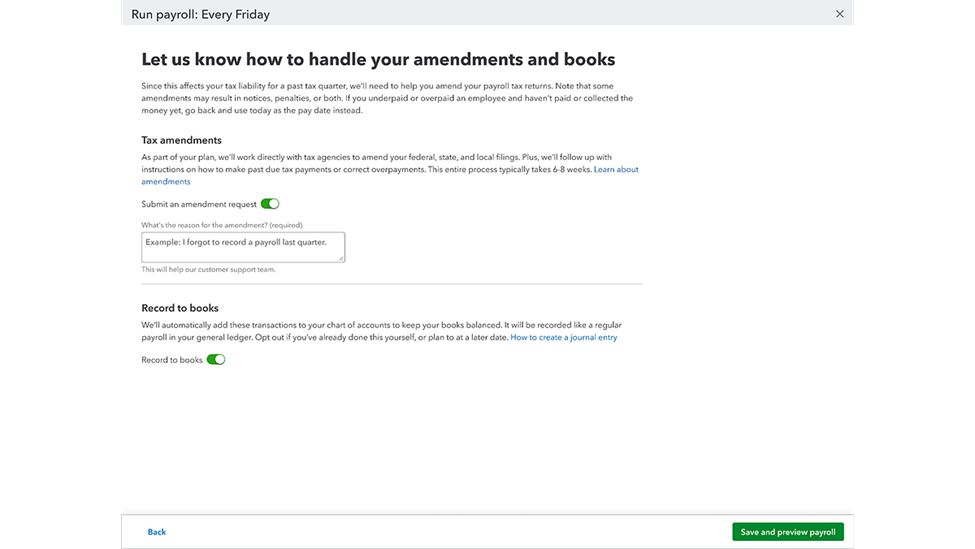

As shown in the illustration below, you will be asked to confirm that you want Intuit to undertake a tax amendment on your behalf, and also to confirm why, in your own words, such an amendment is necessary.

If you recorded the related corrections, tax implications, and payments in QuickBooks itself, the information mustn’t be recorded twice; therefore, you will also need to confirm whether Intuit should make the appropriate entries to your books. Such confirmation is authorized using the bottom toggle shown in the illustration above.

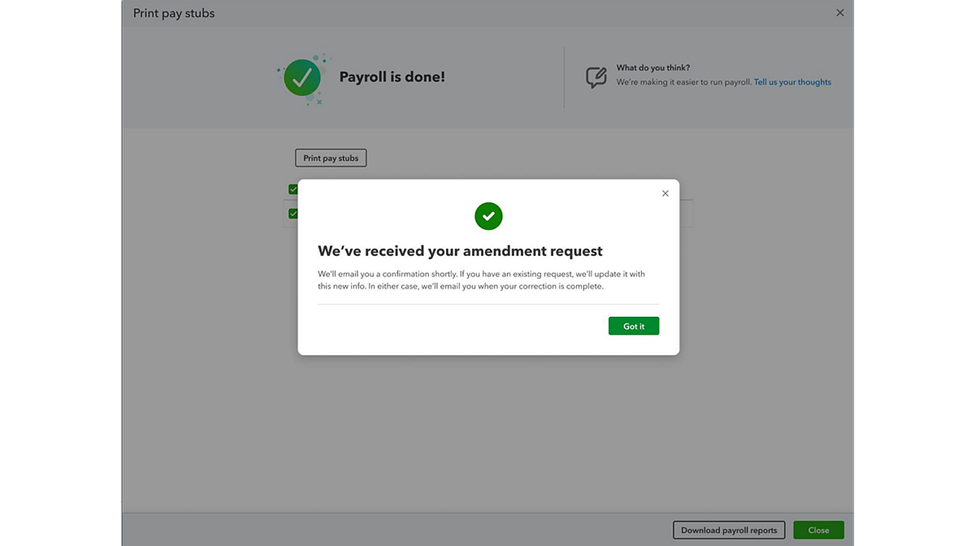

When you ‘Save and submit’ your confirmation(s), you will receive a notice like the one shown below.

Once you open the amendment case, it typically takes 6 to 8 weeks for Intuit to process your amendments and submit them to the applicable tax agencies. If your amendments require a corrected W-2/W-3, such amendments will take about 1-2 weeks to process. However, in either case, processing times can vary depending on when requests occur relative to the regular tax filing season.

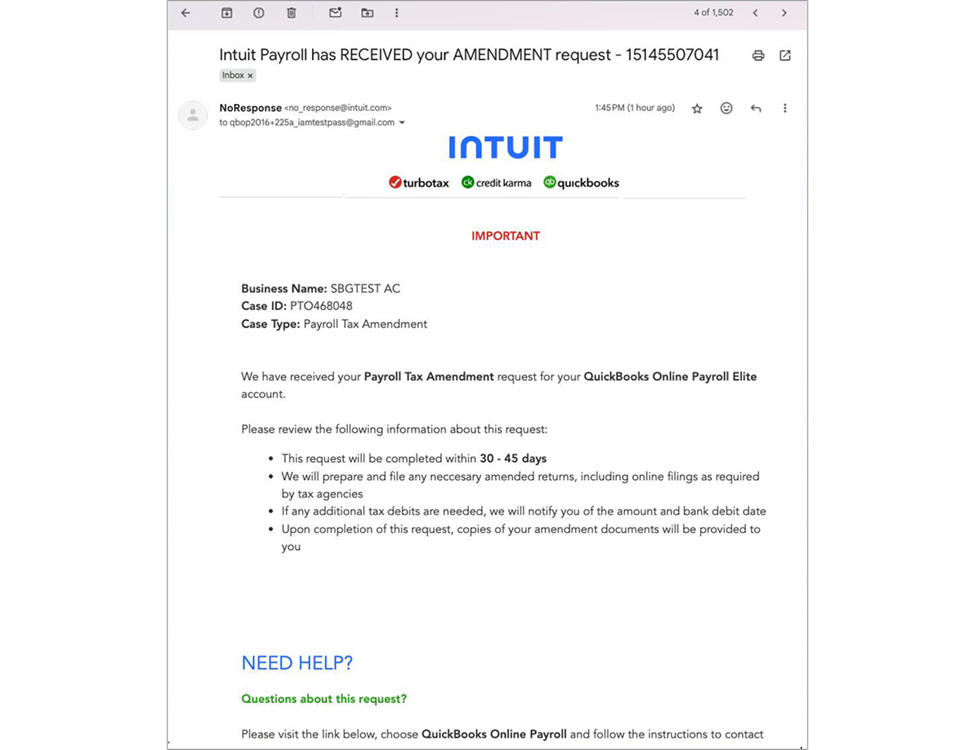

Intuit will email you a confirmation of your amendment request.

If you owe taxes—which you likely will—Intuit will let you know. Be also aware that making changes to past payroll quarters (or years) can result in fines and penalties. For taxes owed or fines and penalties, the payroll subscription holder will be responsible.

Intuit will make copies of amended tax returns available to you for your tax recordkeeping purposes.

Footnotes and Disclosures:

*- Note: Some current Premium or Elite subscribers may not currently have this option, but soon will.

Content (including graphic content) is based on Intuit media source materials and Intuit Help website resources including QuickBooks Online Payroll In-Product Help. Intuit content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, QuickBooks®, QuickBooks Online, and QuickBooks Online Payroll (all SKUs) refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.