ProAdvisors and business owners both told Intuit that the ability to fix payroll after processing was messy, and that they were many times locked out of the process due to timing issues. Now, you and your clients can record payroll, or make payroll corrections, after employees have been paid. You can even void a check and then recreate it with updates, even when the tax payments on the original payroll have been processed, and the changes will create new tax obligations that will be past due.

In all versions of QuickBooks Online Payroll you can now correct payroll mistakes and manage payroll for employees whose paychecks have not previously been recorded in the current tax reporting quarter.

You can create a paycheck with a past check date as long as it’s in the current quarter and tax forms haven't been filed. You also need to be aware that the employee's paycheck will be a printed paper-check, not a direct deposit.

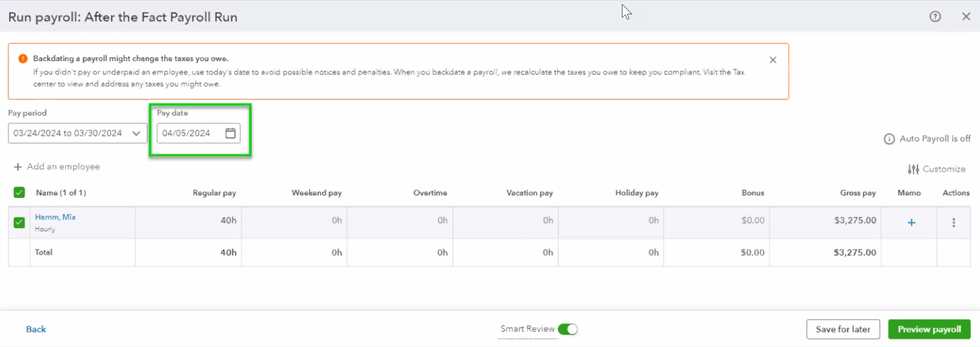

In addition, when you backdate a payroll, you’ll need to immediately pay the taxes owed. QuickBooks Online will recalculate the taxes you owe. Then, depending on your tax filing frequency, you can process the payments yourself in QuickBooks or record the payments you made outside of QuickBooks.

To create a late/backdated/corrected Paycheck in QuickBooks Online

1) Go to Payroll, then Employees.

2) Select Run payroll. If asked, select the payroll schedule.

3) Change the Pay date and Pay period.

4) Select the Employee; then add their salary/hours worked, or corrected amounts.

5) Ensure the payment method is set to Paper check.

6) Then review, and Submit payroll.

7) Go to Taxes, and select Payroll tax. QuickBooks will remind you to do this.

8) Select Payments.

9) Review your tax liabilities, then select Pay for each of the outstanding tax payments.

You've now corrected, backdated or paid a missed payroll for a period and the related taxes.

Disclosures:

Feature content based upon Intuit media source materials and other QuickBooks resources including QuickBooks Help content. Content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, QuickBooks®, QuickBooks Online and QuickBooks Online Payroll, refer to one or more registered trademarks of Intuit® Inc., a publicly traded corporation headquartered in Mountain View, California.

Other trade names or references used herein (if any) may refer to registered, trademarked or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.