Digits' Jeff Seibert on the Role of AI in Accounting at DigitalCPA2025

Some of you may know that earlier this week I 'virtually' attended the DigitalCPA25 conference. I will have a series of articles from various sessions I attended, for which I captured high-quality recordings.

This is the first of those articles, and represents only one portion of the Tuesday, December 9 early General Session titled Hot Seat: AI: Real-World Breakthroughs, Hard Truths, and Bold Predictions, which featured five different speakers, including Jeff Seibert, the Founder and CEO of Digits, the world's first AI-native accounting platform. If you have not read our First Look at Digits, I would encourage you to do so. The second part of our First Look can be found here.

During his 7-minute time slot, Jeff addressed five AI models. He began by discussing Generative AI Models, noting that the audience was likely already familiar with them. He told us that they are also known as LLMs (large language models) and that you might sometimes hear them called foundation models.

Jeff then explained that he was sure everyone (in attendance) had tried ChatGPT. He noted that what it is can literally be found in its name. ChatGPT is a "Generative, Pre-trained Transformer." It's a generative model that was pre-trained on the entire written content of the internet. And it's based on a transformer architecture, as described in a 2017 Google research paper. But Google didn't really do much with that research; however, OpenAI figured out how to use it.

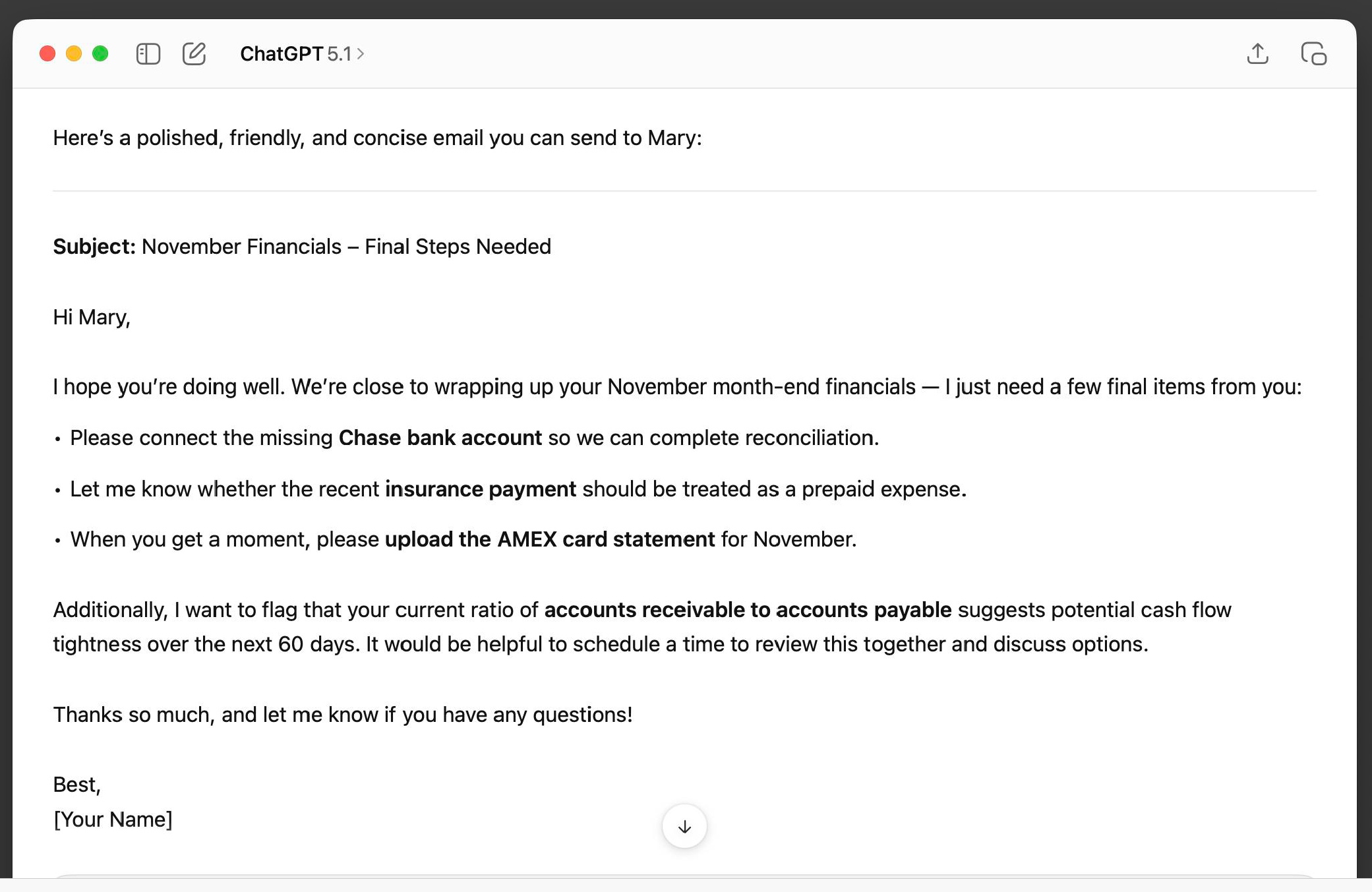

The classic example of ChatGPT's use was writing emails. Let's write a client email. I'm going through the month-end close. I'm taking some notes and bullets, and here's the question. I've told it, "You're a friendly, helpful, knowledgeable accountant, and please draft this into an email." Jeff then pointed out one thing before he showed the results.

I have edited two prompts, right? First, I have given the model a job description. And second, I've given it the input. You only have to write the job description once. And then for every client, you have your bullets, and then ChatGPT spits out an email. Honestly, the email's quite good. You could polish it up, send it off, and everything would be great. While generative models are interesting for various applications, Jeff believes they are the least compelling part of AI.

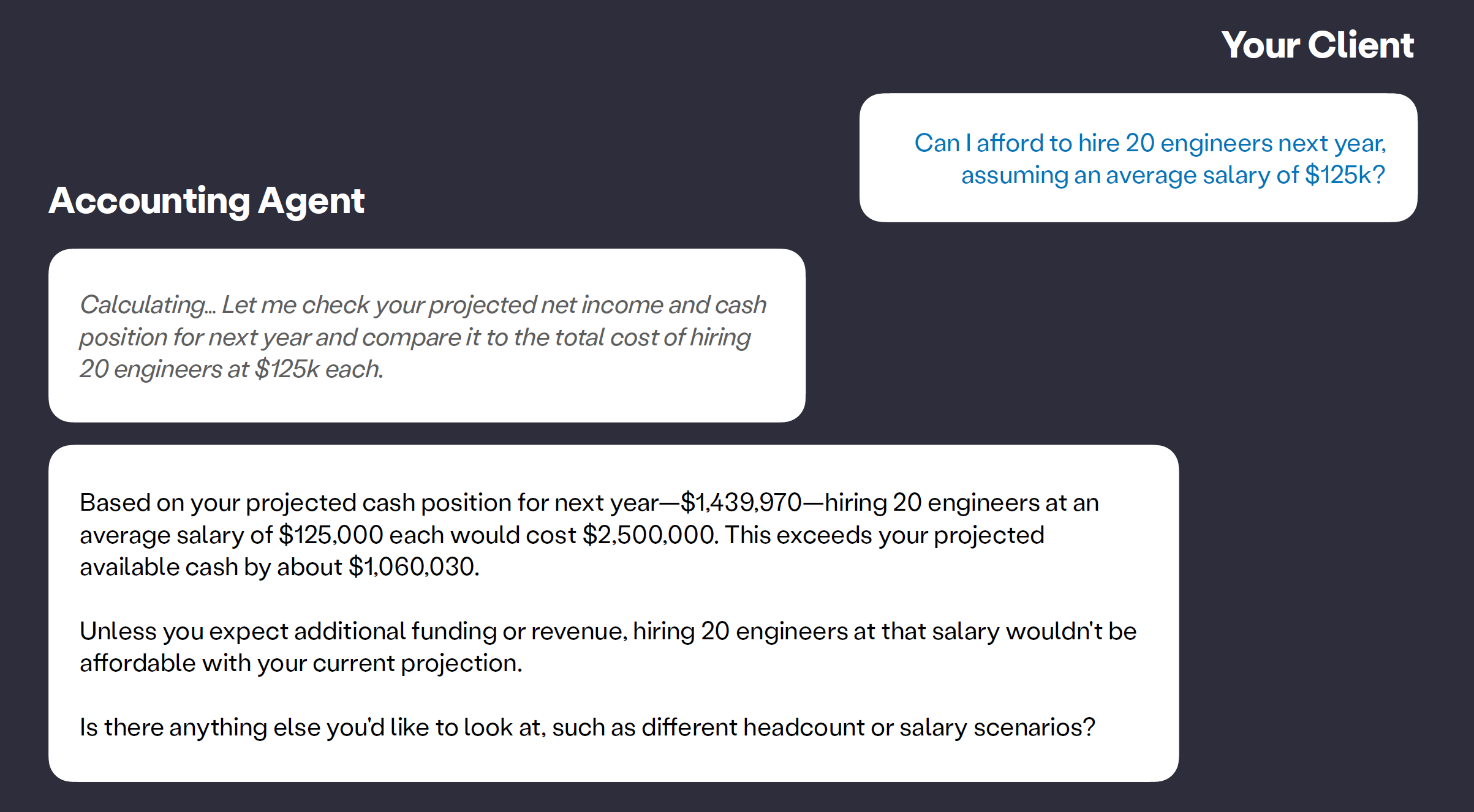

Jeff then discussed AI agents, focusing on a specific example: "Can I afford to hire 20 engineers next year?" An agent can assess your ability to afford this by calculating engineer salaries against your net income. It might respond, "I'm sorry, but you can't hire 20 engineers; however, you could afford 10."

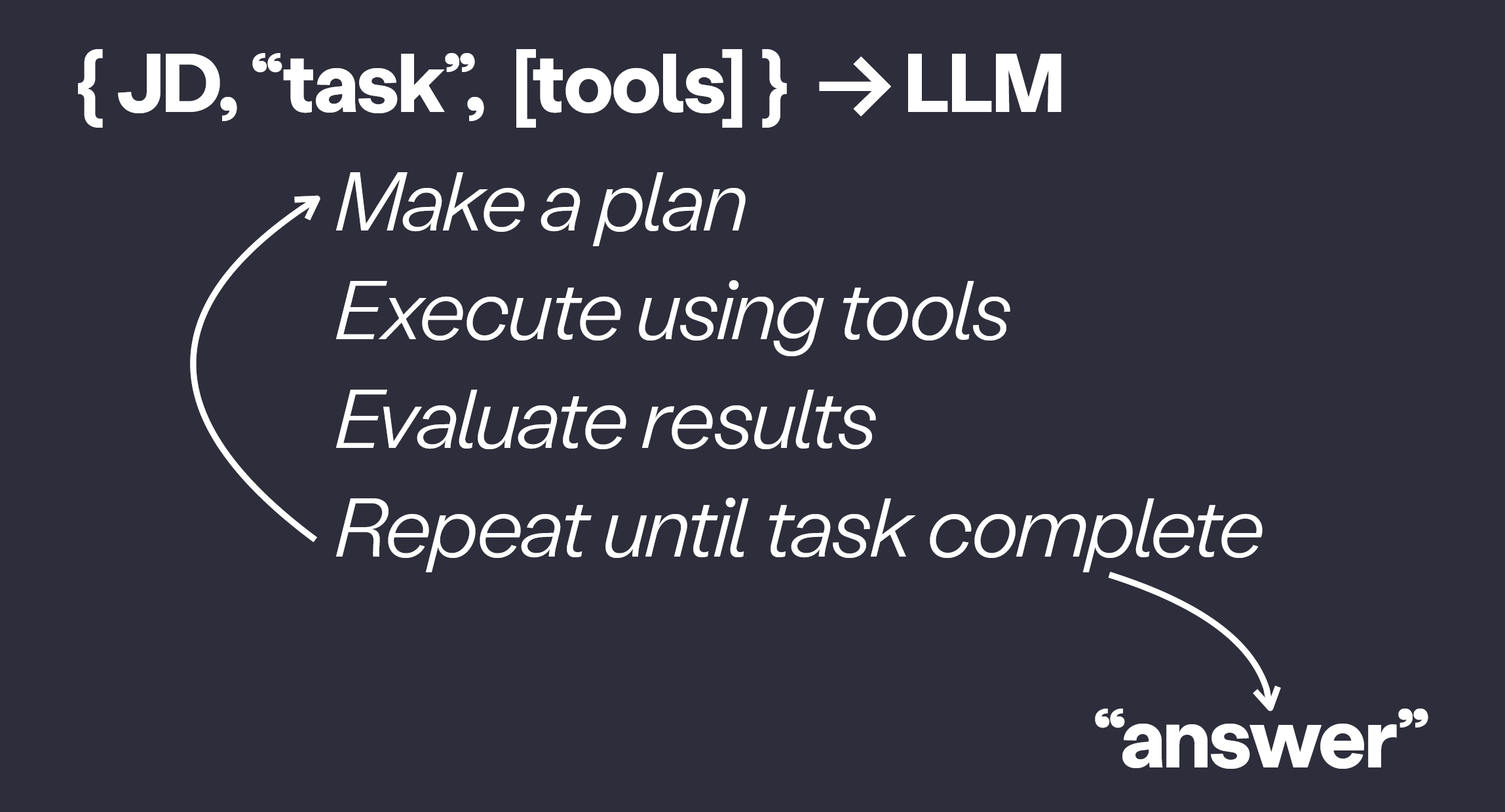

Jeff explained that, at first glance, this appears to be a generative model, yet it operates without a job description. The agent, which functions as a large language model (LLM), needs guidance from its creator. This includes a detailed job description outlining its capabilities and limitations, including a prohibition on fictionalizing data.

The agent processes the input and uses various tools, including traditional programs that it can access. Those tools allow it to look up financial information, run profit-and-loss statements, or calculate hiring costs. The job description instructs the agent to create a plan, evaluate outcomes, and determine success. If the task is not completed, the agent revisits the steps until it arrives at a satisfactory answer, which it then presents.

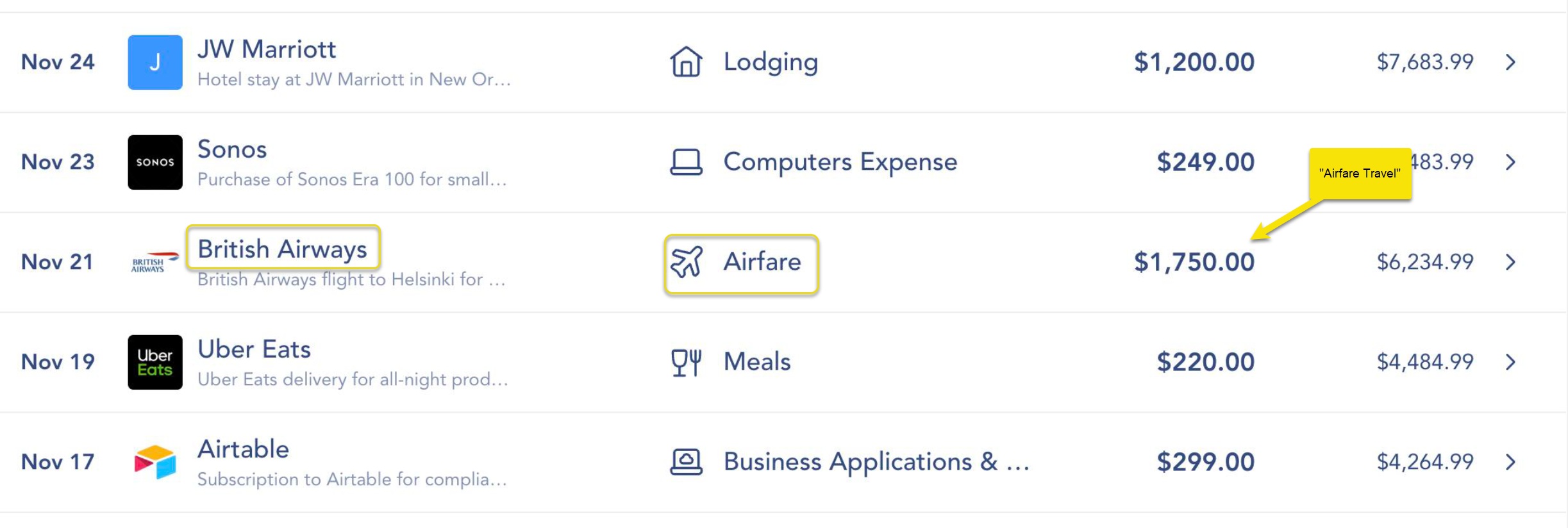

Jeff then turned to Predictive Models, a distinct branch of machine learning focused on classification rather than generative modeling. A typical example comes from the TV show "Silicon Valley," where the question is posed, "Is this a hot dog?" Predictive models analyze inputs and provide probabilities for various outputs, making them effective for transaction classification, such as categorizing a British Airways transaction as airfare travel.

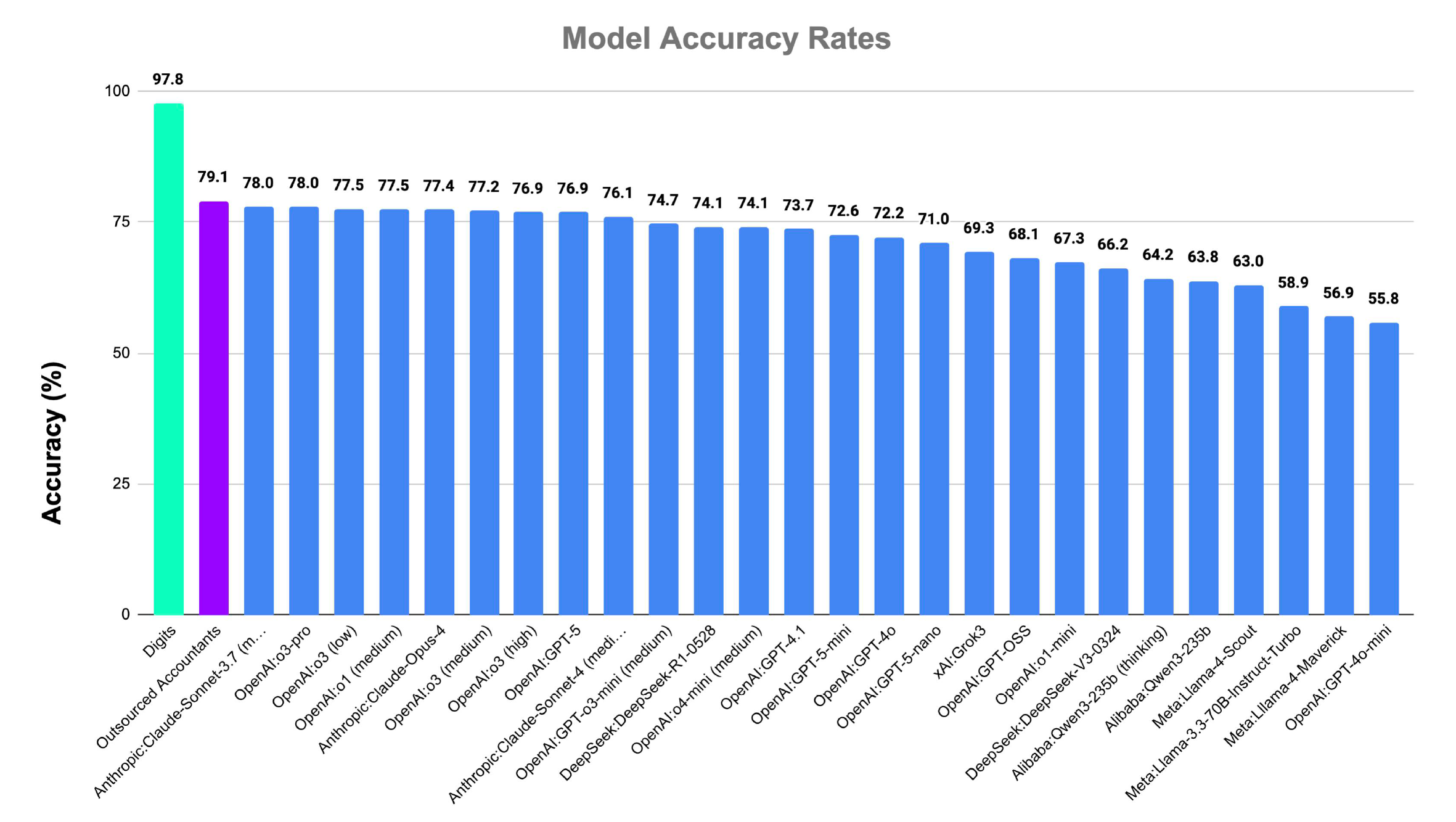

These models significantly outperform large language models (LLMs) in predictive scenarios, especially in bookkeeping, where accuracy is crucial. Unlike generative models, which plateau below 80% accuracy, predictive models leverage specific details about clients and their unique circumstances, enabling them to achieve nearly 100% accuracy—similar to dedicated accountants who know their clients' financial situations.

Before continuing, Jeff reminded the audience, "When tackling a problem, it's essential to choose the right model." Identify the steps needed to address the issue and select a model architecture that aligns with that approach.

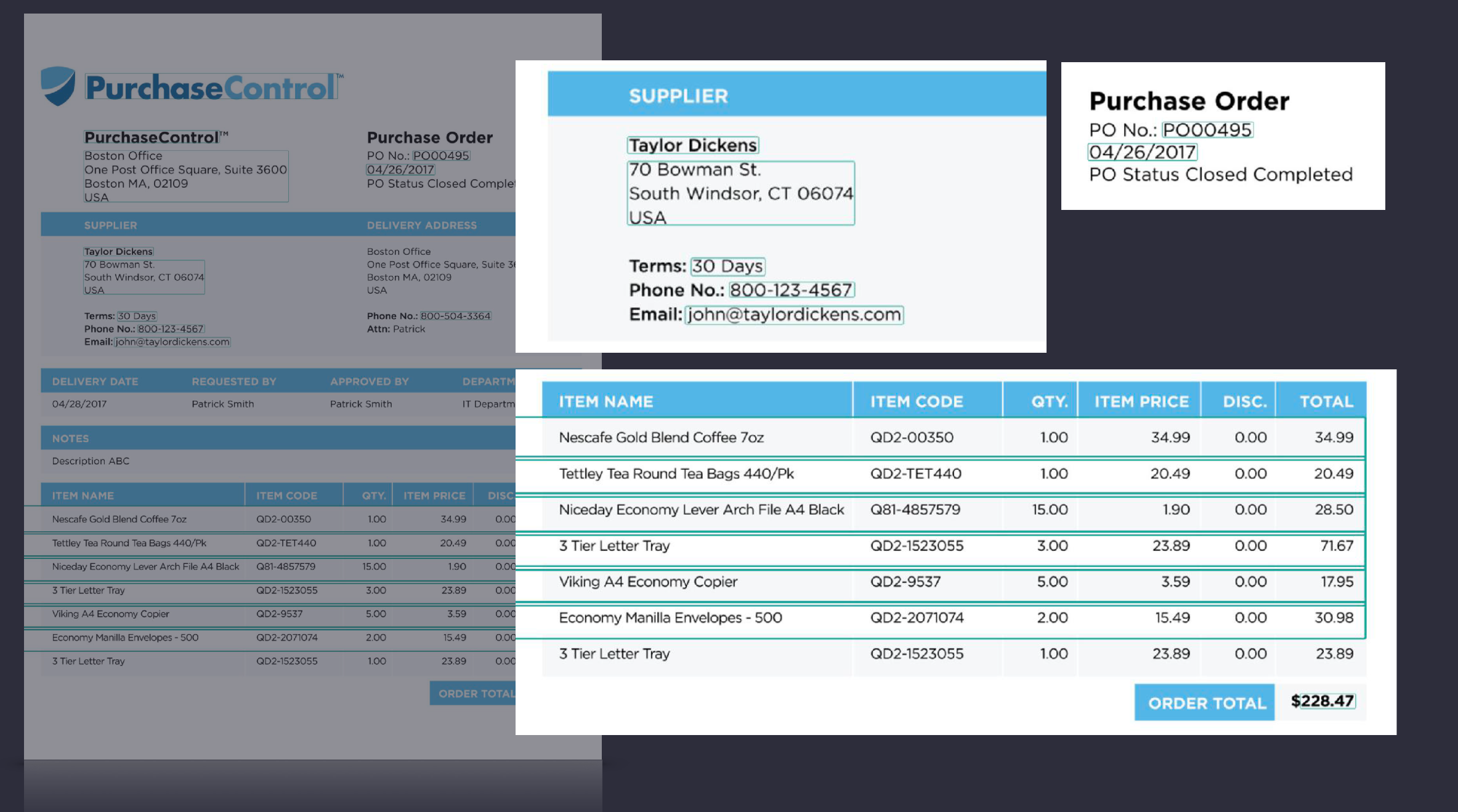

Jeff then moved on to Document Extraction. Almost all of Jeff's audience was familiar with Optical Character Recognition (OCR). While it has its benefits, extracting data from documents like invoices can be tricky, often requiring templates and labeled fields that lead to inaccuracies.

Fortunately, document extraction models now combine OCR with layout-aware language models, trained to understand document structure. This advancement allows even line items ("the Holy Grail of accounting data") to be accurately pulled from invoices.

Jeff then turned to Data Analysis, which has also made strides. It is now possible to conduct a comprehensive analysis that reveals changes in financial records down to the vendor level, month over month, and year over year. However, it's important to note that data analysis often boils down to basic math, and there's no need for AI to solve simple equations.

And then Jeff spoke about one misconception, a lie as he called it, saying, "If anyone claims that AI effectively analyzes financial reports without discussing machine learning, approach them with caution."

That's a summary of Jeff's AI model discussion, which he delivered at DigitalCPA25 in about 5 minutes.

Jeff then reiterated that, as practitioners, it's crucial to understand the tools you have chosen, including the software and models used, and how your data is managed. While many companies are making strides in this field, there's also a lot of hype and misleading claims. Jeff encouraged attendees to dig deeper, understand the models at play, and how they can genuinely benefit the accounting community.

Not knowing how much detail I would be able to garner in the virtual setting, I gave myself a cushion by asking Jeff to comment on each of the three 'learning objectives' related to this session. Below are Jeff's responses to each, which I think you will find beneficial to your exploration of 'AI', especially as it relates to the accounting community.

Jeff, please discuss: "real-world AI implementation cases in public accounting and key factors contributing to successful and unsuccessful outcomes."

Jeff's reply:"We've seen AI implementations succeed in public accounting when firms align the right model type to the right task—predictive models for transaction coding, layout-aware document extraction for statements and invoices, and agents for step-by-step review and research. The firms getting the best outcomes are using AI-native tools as their foundation/system of record, not as one-off tools bolted onto legacy workflows. The biggest failures usually stem from misusing generative models for accuracy-critical work and adopting systems that can't adapt to the nuance of the firm's practice or unique patterns of each client."

Jeff, if you would, please identify: “the potential impact of emerging AI trends related to accounting and financial workflows.”

Jeff's reply: “The next phase of AI in accounting will be defined by systems that don’t just answer questions or draft emails, but actually do the work. Predictive models, document extraction models, and agents are converging into AI-native ledgers that can book transactions, reconcile statements, update schedules, and run variance analysis automatically, with humans supervising the final review. As workflows fade into the background, accountants regain the time and headspace to focus on interpretation, storytelling, and high-impact client conversations. The impact is profound: firms can build deeper client relationships, focus more energy on talent development, and serve more clients at higher margins. Real-time financials will become the norm for most businesses rather than the exception.”

Jeff, can you define: “actionable strategies for integrating AI capabilities in accounting firm processes to improve efficiency or decision-making.”

Jeff's reply: The most strategic move a firm can make is to adopt an AI foundation: moving clients to modern ledger platforms where predictive models, extraction models, and agents all operate together across the entire close process, instead of stitching together disconnected tools. When AI is embedded directly into the ledger, it begins to automate the month-end close end-to-end: booking, reconciling, updating schedules, and surfacing anomalies before humans even touch the file. That shifts the firm’s role from preparation to supervision and communication, freeing accountants to deliver the advisory work clients actually value. Rather than dipping a toe in with isolated use cases, firms should evaluate which platforms will still compound value as AI improves—ensuring the decisions they make today position them for a world where the month-end close is 95% automated by 2026.

I want to thank Jeff Seibert not only for his high-impact presentation at DigitalCPA25 on Tuesday morning, but also for taking time away from his pre-conference preparation to address the learning objectives set for the session. And thanks as well to the Digits' staff who assisted in coordinating my information requests required to complete this article.

I think you will all agree that Jeff clearly has the background and insights that can benefit our education regarding the role of AI in our profession.