Requesting Customer Prepayments (Deposits) on QBO Estimates

Have you routinely required customers to make 'deposits' or 'prepayments' for work you propose in an estimate as a requirement of acceptance of the work or services you will provide?

Collecting a prepayment (customer deposit) confirms the customer's commitment before you start work or purchase materials. It provides some degree of financial security for your business should the client back out of continuing with a service or project after you've spent time and resources. Collecting a deposit also contributes to a business's cash flow during the early stages of a projects or phased services.

To secure a deposit or prepayment in the past, you had to create an estimate and then send the customer an invoice for the deposit or prepayment.

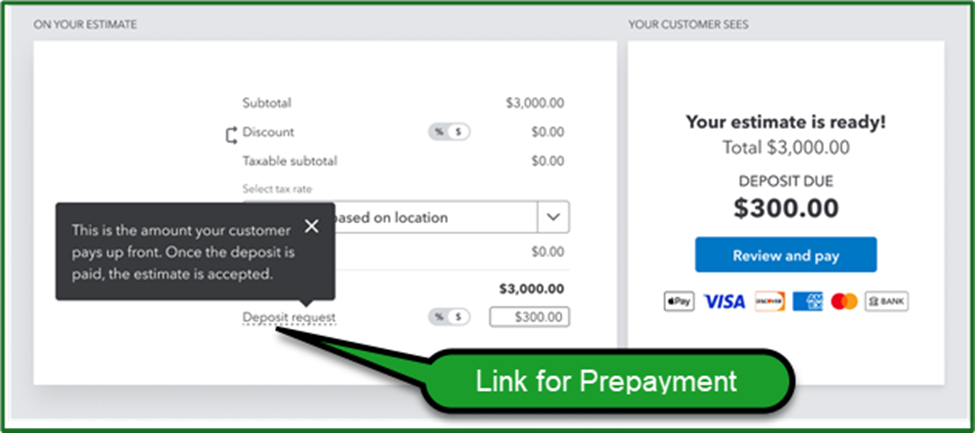

Now, you can use QuickBooks Online Payments to accept deposits for estimates you may be using in your project-based or service-type businesses. With this enhancement, you can now issue customers an estimate for work to be accomplished that includes a built-in payment link, allowing the customer to pay through the QuickBooks Payment portal.

You must be using the new layout for estimates within your QuickBooks Online subscription. To request a deposit or prepayment from a customer:

- Go to Sales.

- Select Estimates.

- Find the Estimate for which you want to add a deposit or prepayment request, then select View/Edit.*

- To enter a specific dollar amount, select $; then, enter the amount.

- Alternately, to enter a percentage of the Estimate total, select %; then, enter the percentage.

- To email the Estimate with a deposit request to your customer, select Review and send. Edit the email message, if appropriate.

- Select Send Estimate.

Upon receiving the Estimate, your client will be able to view and approve it by clicking the 'Deposit Request' link, which enables them to Review and pay through the Payment Portal.

You can view the status of prepayments (deposit) from Sales. To do this:

- Go to Sales.

- Select Estimates.

- In the STATUS column, you will be able to see if your customer paid the prepayment (deposit) you requested in the Estimate.

- Select the More actions ˅ dropdown.

- Choose View activity to see the entirety of the estimate activity.

Footnotes and Disclaimer

*-Your state may have regulations or statutes governing the collection of advanced payments and how they must be accounted for. Similarly, states handle 'sales tax' liability differently on prepayments (deposits). Be sure to check state and local regulations regarding the same.

Graphics and content used within this feature were derived and/or adapted in part from Intuit QuickBooks Online or QBO Payments source materials, as well as Intuit QuickBooks 'Help' content. Adapted source materials published within this feature by Insightful Accountant are for educational and product promotional purposes only.

QuickBooks, QuickBooks Online and QuickBooks Payments, as used herein, refer to one or more registered trademarks of Intuit, Inc., a publicly-traded corporation headquartered in Mountain View, California.

Other trade names used herein, including any other vendor (app/software) products discussed, may be registered, trademarked, or otherwise held by their respective owners and are now acknowledged accordingly. They have been referenced for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendors within this article have paid Insightful Accountant or the Author any remuneration to be included within this feature. This article is provided solely for informational and educational purposes.

The publication of this article does not represent any form of endorsement by either the Author or Insightful Accountant.

Note: Registered Trademark ® and Copyright © symbols have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they might otherwise appear or be repeated. We attempt to credit such trademarked products or copyrighted materials within our respective article footnotes and disclosures.