QBO Sees Sales Tax Enhancements

Enhancements made to QuickBooks now permit the transmittal of sales tax returns directly from within QuickBooks Online when remittance is being made to a select group of state Tax agencies.

If you are a business user of QuickBooks Online, and have been using QBO to track your sales taxes, you can now pay your sales (and use) taxes to the state's taxing authority for Iowa, Minnesota, North Carolina, Rhode Island, Vermont or West Virginia. Iowa returns are monthly filing only. Minnesota, North Carolina, Rhode Island, Vermont and West Virginia can be filed monthly or quarterly depending on the businesses filing requirements.

For these six states users can create sales tax returns using their QuickBooks sales tax data with the tax returns formatted properly for those states. QuickBooks Online does not presently support the electronic filing of sales tax in all states. Intuit anticipates that state filing of sales tax within QBO for additional states will be rolled-out over the course of time.

Users can also track the status of their sales tax returns in real-time. All tax returns filed using this method are stored so they can be referenced in the future at any time. This new feature also allows users to set-up reminders of their sales tax deadlines.

There is a cost to this new service of $40.00 per filing.

Filing and Saving Your Sales Tax in QBO

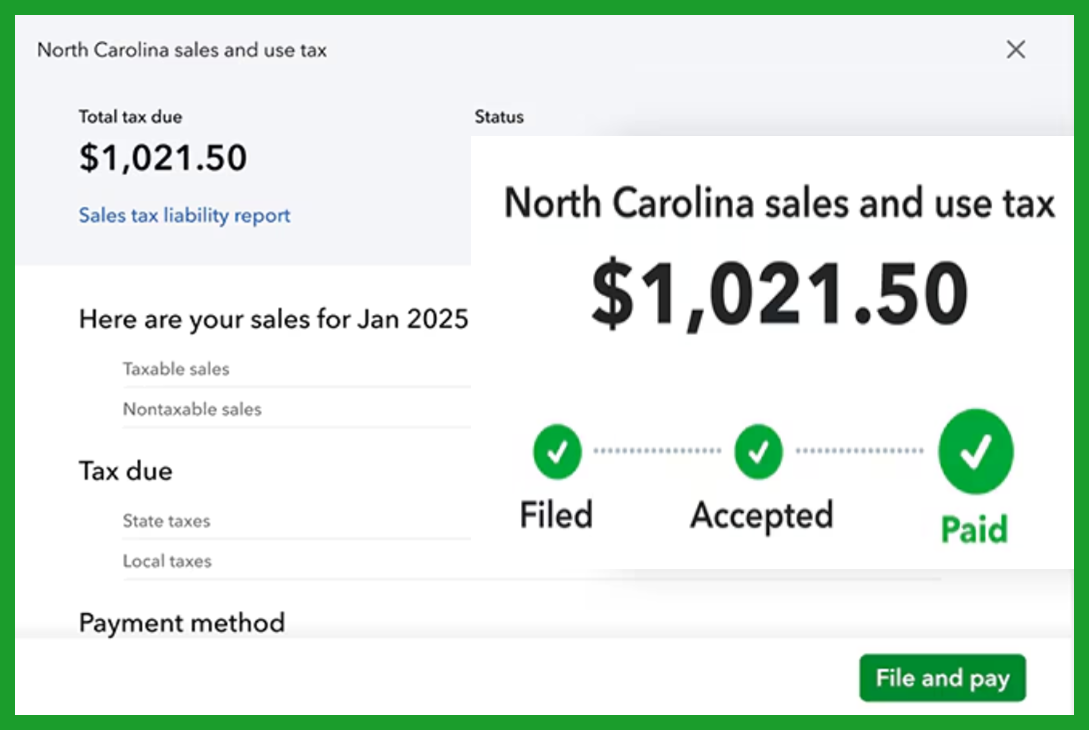

You can now file and pay your state sales (and use) taxes in the states of Iowa, Minnesota, North Carolina, Rhode Island, Vermont and West Virginia, directly within QuickBooks Online. Below is the step-by-step:

1) In QBO, go to Taxes,

2) Select Sales tax.

3) From the Action column, select File return.

4) Select Add no to enter the tax account ID or the EIN/SSN of the filing entity. (Alternatively, select Edit if you need to change that information.)

5) Verify the Total Sales Amount, the Non-taxable Sales, and the Taxable Sales amount (fields) which are populated from your sales tax liability report.

6) Verify the State and Local level taxes.

7) You can add Sellers purchases (Use Tax) directly on the form and QuickBooks will update the total. Select an Account or create a new one as needed.

8) Add the Payment information.

9) After you are satisfied that all of the information is accurate, select the Disclaimer.

10) Then, select File and Pay.

11) The return along with ACH payment information is transmitted to the State Agency responsible for tax collection. That agency will collect the tax based on the transmitted ACH payment details. It can take as many as five (5) working days for the payment to be collected by the State Agency.

NOTE: You will need to post the payment in your bank register, QuickBooks does not do so as part of the tax filing process. You can choose to post it manually, or via bank feeds when the payment is transmitted by your bank as part of bank feed processing.

12) Within a minute after the tax return is filed, the status of the return within QuickBooks will show "Pending." Anywhere from one-hour to two-days after transmittal, the status of the return within QuickBooks will shown return confirmed, you will also receive an email from QuickBooks regarding that confirmation status.

Disclosures:

Content (including graphic images) based on Intuit source materials including media source content from Intuit websites and the QuickBooks Online 'in-product help'. Intuit content adapted by Insightful Accountant from Intuit sources is furnished for educational purposes only.

As used herein, QuickBooks Online refer to one or more registered trademarks of Intuit® Inc., a publicly-traded corporation headquartered in Mountain View, California.

Any other trade names or references used herein may refer to registered, trademarked, or copyrighted materials held by their respective owners; they are included in the content for informational and educational purposes only.

This is an editorial feature, not sponsored content. No vendor associated with this article has paid Insightful Accountant or the author any form of remuneration to be included within this feature. The article is provided solely for informational and educational purposes.

Note: Registered Trademark ® and other registration symbols (such as those used for copyrighted materials) have been eliminated from the articles within this publication for brevity due to the frequency or abundance with which they would otherwise appear or be repeated. Every attempt is made to credit such trademarks or copyrights within our respective article footnotes and disclosures.