Ignition Launches New AutoCollect to End Late Payments

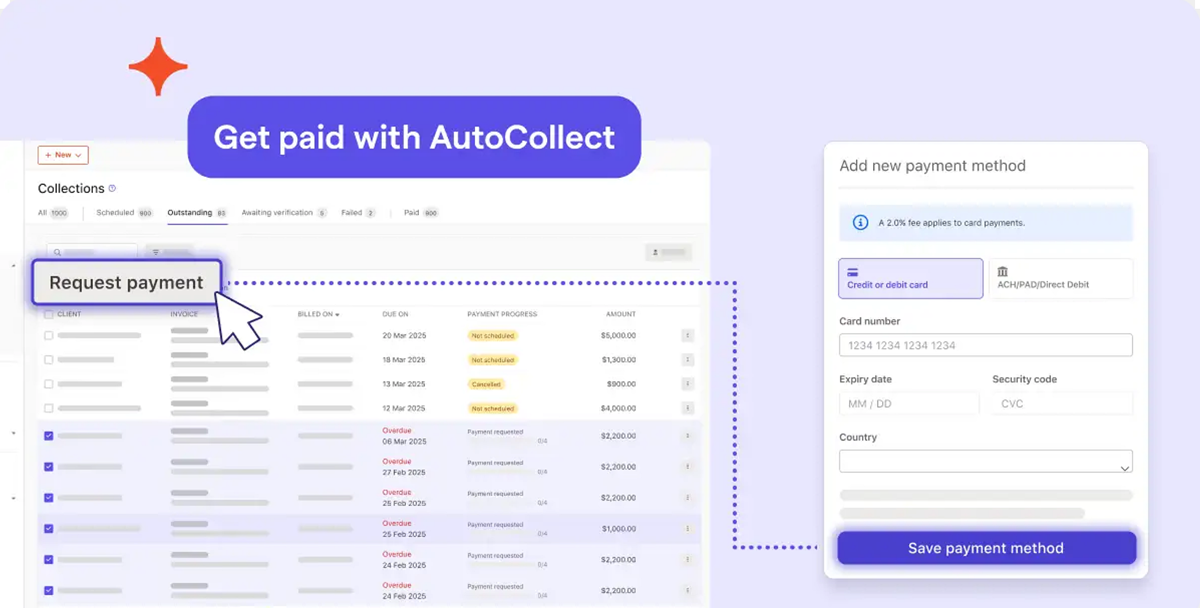

Ignition, a revenue and billing automation platform for service-based businesses, today introduced AutoCollect, the latest advancement in its mission to help companies eliminate late payments. With AutoCollect, customers can automatically import and get paid for invoices created in their accounting software integrated with Ignition, including QuickBooks Online and Xero.

“We need to stop the cycle of service-businesses having to negotiate twice; first for the contract, and then to get paid. Late payments hurt small to medium businesses, impacting the ability to make payroll, pay rent, or hire needed employees,” said Greg Strickland, CEO of Ignition. “Our goal is to wipe out late payments for good and help businesses reclaim their cash flow. AutoCollect is the next piece of the puzzle in Ignition’s payments suite to make getting paid for every invoice as easy as possible.”

More than half of US small businesses are not paid on time. Some industries suffer even more, with an Ignition study revealing that 94 percent of accountants and bookkeepers chase clients for late payments.

AutoCollect helps professional services businesses overcome these challenges by:

- Auto-importing unpaid invoices into Ignition from their accounting software, including QuickBooks Online and Xero

- Inviting clients in bulk to pay securely via an online portal

- Providing the option to pre-save payment methods

- Turning on automated collections for future invoices

AutoCollect is the latest addition to Ignition’s proven payment features, such as collecting payment details upfront and pre-authorizing payments when clients sign a proposal, to help businesses better manage cash flow. 91% of payments in Ignition are collected automatically to ensure customers get paid on time and eliminate accounts receivable.

"Ignition has transformed the way we manage overdue invoices and collect payments, helping us get paid faster,” said Jack Colvin of Counting Clouds. “The ability to batch and send payment requests from a single platform has been a game changer. The consolidated view of all payments makes it so much easier to manage both packaged and hourly billing without switching between systems."

About Ignition

Founded in 2013, Ignition is the leading revenue operations platform for services-based businesses to transform their sales, billing, and payment processes. Ignition automates proposals, invoicing, payments, and workflows in a single platform, empowering 8,000+ firms to sell, bill, and get paid for their services easily. To date, Ignition customers have managed relationships with over 1.9 million clients and earned $9b in revenue via the platform. Ignition’s global workforce spans Australia, Canada, New Zealand, the Philippines, the US, and the UK.

Disclosure:

Feature content developed from media source information provided by AquaLab Public Relations on behalf of Ignition. Content within this Insightful Accountant feature is provided for informational and educational purposes only.

Viewer tier: free

Post tier: free