Apply S-Corp Medical at Year-end for Corporate Officers

This article assumes that you are using QuickBooks (desktop) and QuickBooks Enhanced Payroll. QuickBooks Payroll allows for two different methods by which you can track Medical Health Premiums for S-Corp Officers. You may have been processing S-Corp Health Insurance premiums using a Scorp Pd Med Premium Payroll Item all year long, but many S-Corps will choose to simply apply the S-Corp Health Insurance premiums they have been paying to an officer’s payroll at year end. This article discusses the method for making these year-end payroll adjustments.

S-Corp Medical health premiums increase taxable wages and tax deductions. If your corporate officers who are at least 2% shareholders elect to apply the health insurance to their wage base at the end of the calendar year, even though the company has been making premium payments throughout the year, you can use one paycheck in QuickBooks to report the amount of S-Corp Medical benefits that have paid for the year to the S-Corp’s qualified shareholders.

By following these steps, you will be applying S-Corp Medical on a paycheck for a shareholder who will not receive any more wages this year. You must determine how to create these year-end adjustment paychecks, based on how you set up the payroll item. Select whichever of the two options below actually applies to your own situation.

Option 1 - If Your Medical Plan Is Offered to All Employees and You Created a Payroll Item with a Tax Tracking Type of S-corp Pd Med Premium

-

1 - Verify that you have created the S-Corp payroll item with tax tracking of S-corp Pd Med Premium. (Note: Before creating paycheck to report the S-Corp Medical, you must have created the S Corp Medical company contribution payroll item based on the appropriate taxability. If you are unsure how the item should affect tax forms or its taxability, consult with your accountant/tax advisor for assistance.)

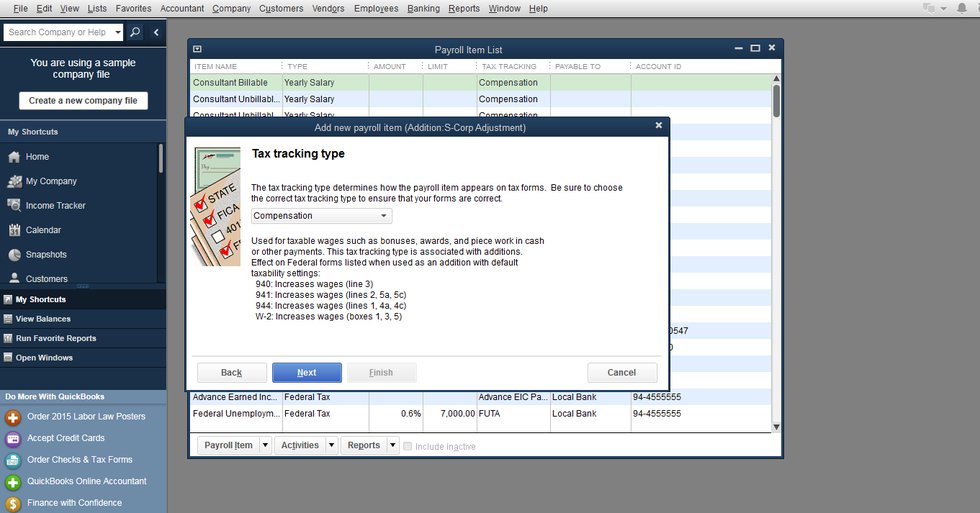

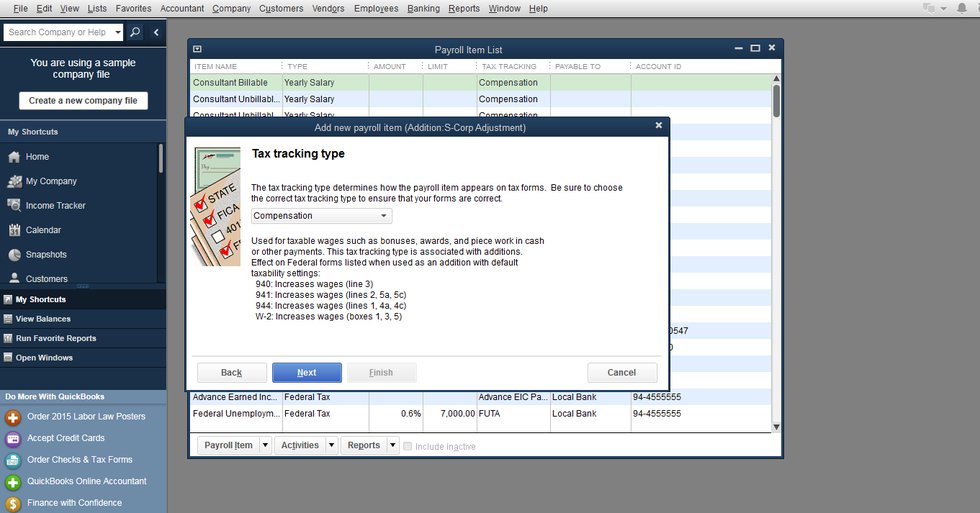

2 - Create a new addition payroll item named S-Corp Adjustment with a Tax tracking type of Compensation. The account should remain Payroll Expenses.

- QuickBooks will not create this paycheck without an earnings or addition item; therefore you must create this addition payroll item called S-Corp Adjustment. This item is used to create a zero balance or a net amount of zero on the paycheck.

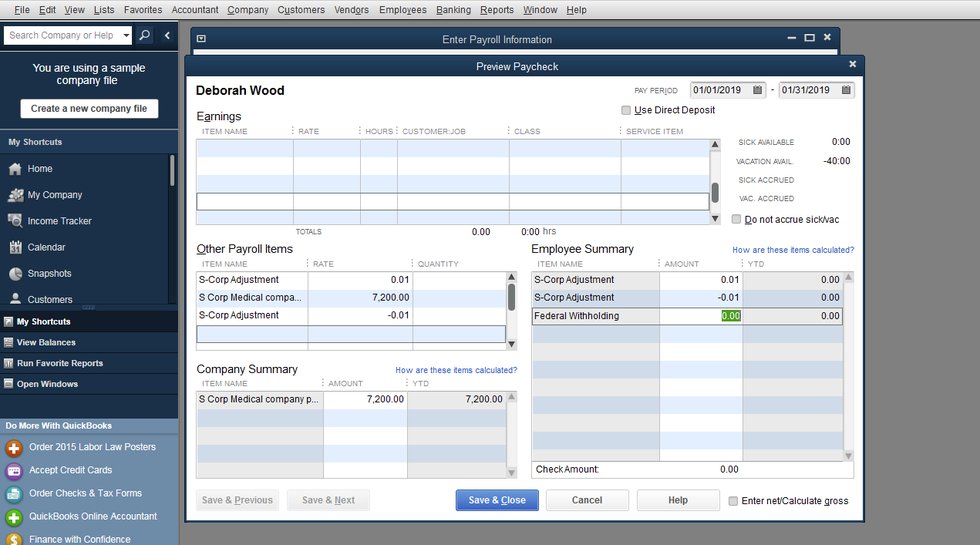

3 - Create a new paycheck for the corporate officer and click Preview Paycheck

4 - Remove any earnings item all other items (start with a blank paycheck).

5 - Under Other Payroll Items:

- Enter the S-Corp Adjustment payroll item created in Step 2, for the amount of .01 on the next line.

- As your next item, add the S Corp Medical company contribution and the entire amount of the premiums paid for this officer.

- On the third line, enter the S-Corp Adjustment payroll item again, this time for the amount of -.01.

6 - In the Employee Summary, you can edit the taxes to zero out the federal and state income tax (FIT and SIT).

7 - The paycheck should be for a zero net amount. (Note: In order to prevent zero-dollar paychecks from appearing in your regular ‘bank account’ used for Payroll you may wish to post this paycheck to a different ‘bank account’, created just for this purpose such as “S-corp Pd Med Premium Adjustment Clearing Account”.)

8 - Create the paycheck.

9 - Be aware that payroll items used for creating these paychecks will show positive balances in your Payroll Liability report. If you have already paid the premium for S-Corp medical, and wish to zero out the balances showing as owed, you will need to perform a company level liability adjustment.

Option 2 - If The 2% Shareholders Have a Different Plan from the Other Employees and You Created a Payroll Item with a Tax Tracking Type of Fringe Benefits

-

1 - Verify that you have created the S-Corp payroll item with tax tracking of Fringe Benefit. (Note: If you are unsure how the item should affect tax forms or its taxability, consult with your accountant/tax advisor for assistance.)

2 - Create a new Addition payroll item named S-Corp Adjustment with a Tax tracking type of Compensation. The account should remain Payroll Expenses.

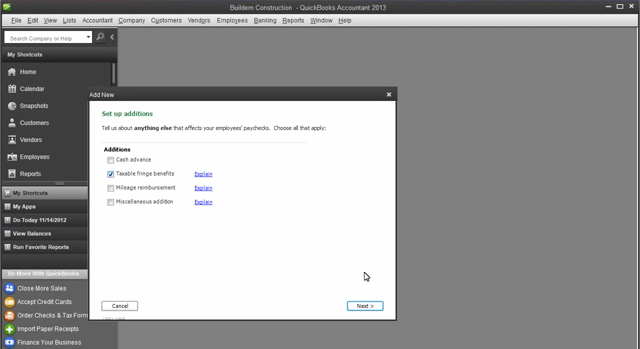

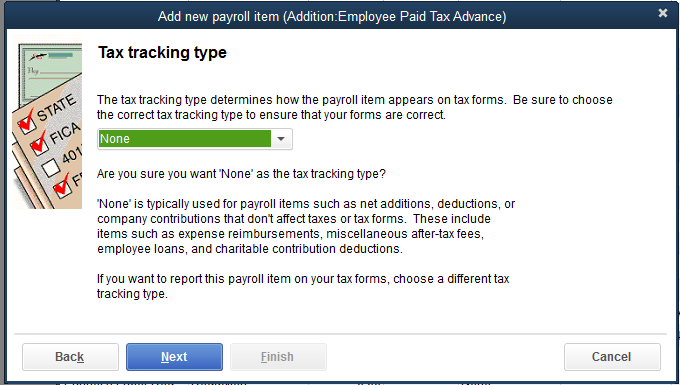

3 - Create a second new Addition payroll item with a Tax tracking type of None. You can call it Employee Paid Tax Advance.

- If you are creating a paycheck without any earnings item and using only a Company Contribution item with Tax Tracking of fringe Benefits, QuickBooks will calculate and deduct Employee paid taxes from the total amount, resulting in negative net amount. QuickBooks will not create a paycheck with a negative net amount. To get around this, you can create an Advance Addition item > tax tracking None. You will use this item to cover the employee paid taxes calculated on paycheck so that the end result is a net amount of zero. (Note: Make sure that you recover from these individuals the amount you are issuing as advance by April 30 of the following year, otherwise, you will have to report this as taxable compensation later on.)

4 - Create a new paycheck for the corporate officer and click Preview Paycheck.

5 - Remove any earnings item all other items (start with a blank paycheck).

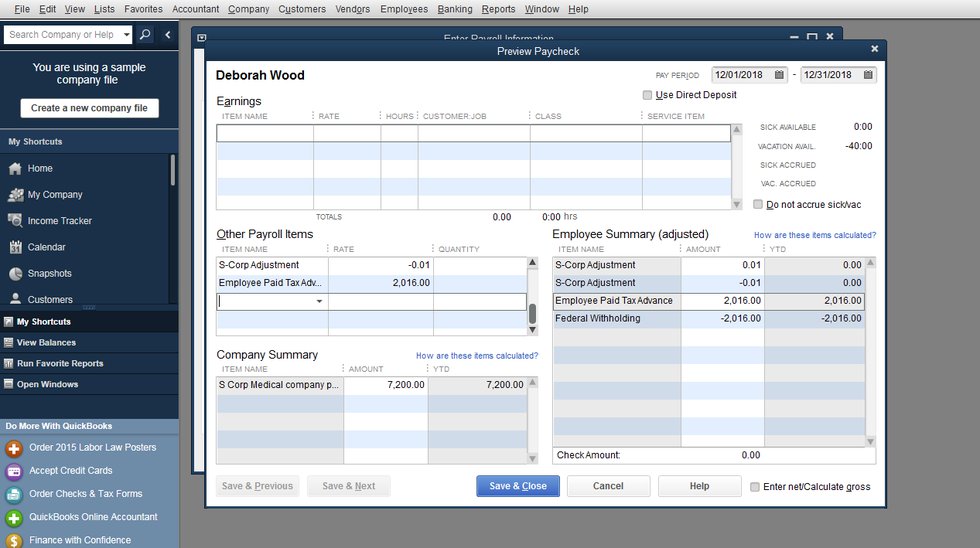

6 - Under Other Payroll Items:

- Enter the S-Corp Adjustment payroll item created in Step 2, for the amount of .01.

- On the line below, add the S Corp Medical company contribution and the entire amount of the premiums paid for this officer. QuickBooks will calculate the employee paid taxes and will post these amounts as negative.

- On the next line below, enter the S-Corp Adjustment payroll item again, this time for the amount of -.01.

- As your next item, enter the Employee Paid Tax Advance payroll item you created in Step 3. Next to this item, enter the total net Check amount from the paycheck.

7 - You should now have a paycheck with a net amount of zero. (Note: In order to prevent zero-dollar paychecks from appearing in your regular ‘bank account’ used for Payroll you may wish to post this paycheck to a different ‘bank account’, created just for this purpose such as “S-corp Pd Med Premium Adjustment Clearing Account”.)

8 - Create the paycheck.

9 - Be aware that payroll items used for creating these paychecks will show positive balances in your Payroll Liability report. If you have already paid the premium for S-Corp medical, and wish to zero out the balances showing as owed, you will need to perform a company level liability adjustment.

Editor's note and Disclosure:

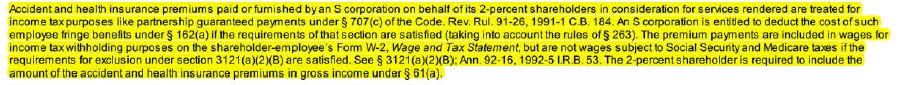

While we believe, based upon a review of the applicable provisions by our consulting tax advisor, the controlling provisions of the tax code in this situation are:

Exception for S corporation shareholders. Do not treat a 2% shareholder of an S corporation as an employee of the corporation for this purpose. A 2% shareholder is someone who directly or indirectly owns (at any time during the year) more than 2% of the corporation's stock or stock with more than 2% of the voting power. Treat a 2% shareholder as you would a partner in a partnership for fringe benefit purposes, but do not treat the benefit as a reduction in distributions to the 2% shareholder.

S corporation shareholders. Because you cannot treat a 2% shareholder of an S corporation as an employee for this exclusion, you must include the value of accident or health benefits you provide to the employee in the employee's wages subject to federal income tax withholding. However, you can exclude the value of these benefits (other than payments for specific injuries or illnesses) from the employee's wages subject to social security, Medicare, and FUTA taxes.

This article is presented for information purposes only. If you are unsure how the item discussed in this article should affect tax forms or taxability; you should consult with your own accountant and/or tax advisor for assistance.